There is nothing that can pull the U.S. out of this multi-year 'real recession,' warns 'Big Short' Michael Burry

Despite the better-than-expected Q3 GDP data Wednesday morning, "The Big Short" investor Michael Burry is projecting an unavoidable, "real" multi-year recession for the U.S.

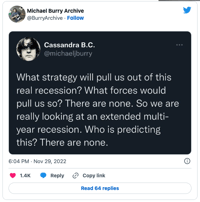

In a now-deleted tweet, Burry told his followers: "What strategy will pull us out of this real recession? What forces would pull us so? There are none. So we are really looking at an extended multi-year recession. Who is predicting this? There are none."

After two consecutive quarters of contraction, the U.S. economy picked up in Q3. The second estimate released Wednesday morning showed that the U.S. GDP rose 2.9% versus markets' expectations of a 2.7% increase. This comes after two negative readings of -1.6% and -0.6% in Q1 and Q2, respectively.

But with the Federal Reserve raising rates by 350 basis points year-to-date, the U.S. economy is bound to slow. And Burry's outlook is far from optimistic. Markets are also looking for another 50 basis-point increase at the December FOMC meeting.

In the short term, investors are focused on the U.S. jobs report from October, which will be released this Friday. The idea is to gauge how aggressive the Federal Reserve will have to be into the year-end.

Earlier this month, Burry highlighted gold in a rare comment, stating that this is the time for the precious metal to rally, citing the crypto contagion risk post-FTX collapse.

"Long thought that the time for gold would be when crypto scandals merge into contagion," Burry said in a tweet that has since also been deleted. Burry is known to delete his tweets shortly after posting them.

Overall, the fund manager has been bearish on the market, revealing earlier this month that he has a sizeable short position. "You have no idea how short I am," he said in another tweet.

Burry, who runs the hedge fund Scion Asset Management, is known for spotting the mortgage crisis early and making a fortune against the U.S. housing bubble. In 2019, the investor also made millions by purchasing shares of GameStop, which was well before the Reddit frenzy took over the stock.