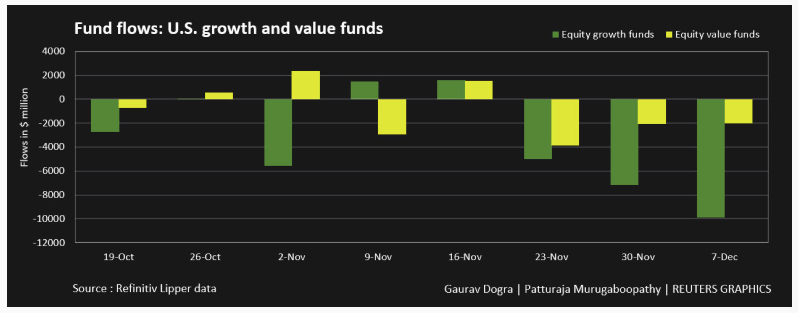

U.S. equity funds register biggest weekly outflow in about 1-1/2 years

Saudi Crown Prince Mohammed bin Salman and Chinese President Xi Jinping in Hangzhou, China, in September 2016.Lintao Zhang/Getty

George Glover Dec 9th, 2022

U.S. equity funds posted enormous outflows in the week to December 7 as investors fretted over the Federal Reserve’s rate hikes, with data showing a rebound in employment and a pick up in the services sector.

According to data from Refinitiv Lipper, U.S. equity funds recorded withdrawals of $26.66 billion, the biggest weekly outflow since April 2021.

Graphic: Fund flows: US equities, bonds and money market funds, Reports showing an upbeat U.S. services industry activity and higher-than-expected nonfarm payroll additions in November raised bets that the Federal Reserve will remain more hawkish than expected.

Investors were also worried as the biggest U.S. banks including Goldman Sachs, J.P. Morgan, and Bank of America, warned of a recession as inflation threatens consumer demand.

U.S. equity growth funds saw $9.91 billion worth of withdrawals while value funds witnessed net disposals of $2.03 billion, as selling continued for a third straight week in each segment.