Business Insider: Switch up your portfolio as the Israel-Hamas war threatens to fuel inflation and reshape global power, veteran analyst Larry McDonald says

-

Americans may want to rejig their investments as the Israel-Hamas war rages, Larry McDonald says.

-

He sees value in a "multipolar world portfolio" that protects against US inflation and debt risks.

-

The market analyst says the S&P 500 has its drawbacks, with higher interest rates threatenening stocks.

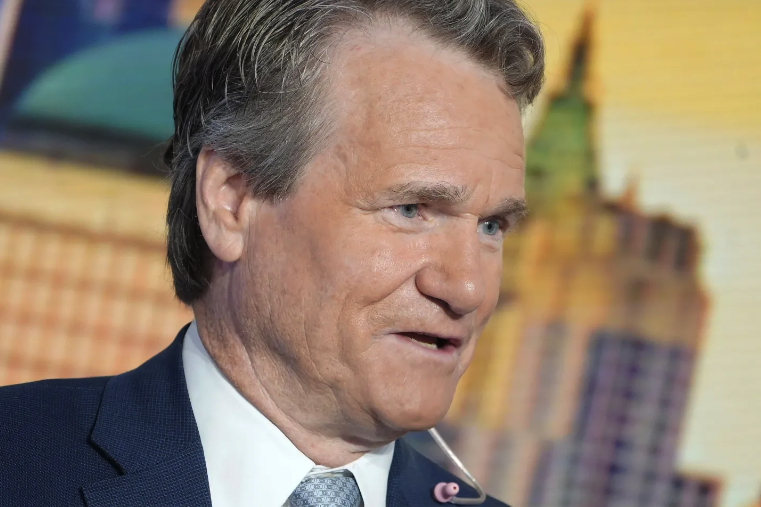

US investors are overwhelmingly invested in America's financial markets and a future where it remains the dominant global superpower — but the Israel-Hamas conflict may signal it's time to diversify, Larry McDonald says.

"We are on the doorstep of a multipolar world portfolio," the founder of "The Bear Traps Report" told Fox Business last week. He warned that the US government's budget is likely to be stretched next year by ballooning interest payments on the national debt and calls for military aid from both Ukraine and Israel – and that funding those expenditures could suck up cash and fuel inflation, potentially putting pressure on parts of the economy.

"Really a multipolar world is higher inflation, higher bond yields, hard assets — real assets that are going to protect you from a higher inflation regime," McDonald said.

The veteran investor added that the S&P 500 offers investors little exposure to inflation hedges like precious metals, materials, and oil. Those three sectors make up 14% of the benchmark index compared to about 50% in the 1980s, he noted.

McDonald is a former Lehman Brothers trader – and his book "A Colossal Failure of Common Sense" is about the investment bank's collapse in September 2008, which helped trigger a global financial crisis.

He's also known for his bleak warnings and dramatic predictions about market crashes and economic catastrophes.

For example, McDonald recently that interest rates, which the Federal Reserve has hiked from nearly zero to north of 5% since last spring in an effort to rein in runaway inflation, pose a material danger to stocks. Higher rates lift bond yields which slashes the relative appeal of stocks, makes it more expensive for companies to secure financing, and encourages people to save their money rather than spending or investing it.

"Rate risk today is exponentially higher," McDonald said Sunday in on X.

In another recent post, McDonald quoted JPMorgan CEO Jamie Dimon saying that "now may be the most dangerous time the world has seen in decades."

"The entire nation's (USA) wealth is set up in a unipolar world portfolio, all heading into a multipolar world, hmmm," McDonald said.

The veteran market analyst clearly sees mounting risks to US stocks, ranging from a surge in borrowing costs to spiraling government debt and foreign wars. In his view, investors would be wise to hedge their bets in terms of assets, industries, and geographies.