Q3 2022 Platinum Overview and Forecast

Background

The role of Central Bank reserves is to provide a reserve for the creation of stability in currency and balance of payments management and to provide a cushion during times of stress. Historically these reserves protected against stresses resulting from liquidity, solvency, inflation and external economic shocks.

In general the IMF requires that reserve assets always refer to assets that actually exist. Credit lines, guarantees and central bank swap arrangements are not recognised as actual assets and, therefore, are not reserve assets although in certain circumstances forward contracts and options may be eligible. Gold and platinum remove any doubt in terms of credit or counter-party risk.

Central Banks favor assets that are liquid, have little or no credit risk and which diversify their holdings and have low correlations with other asset classes and financial markets.

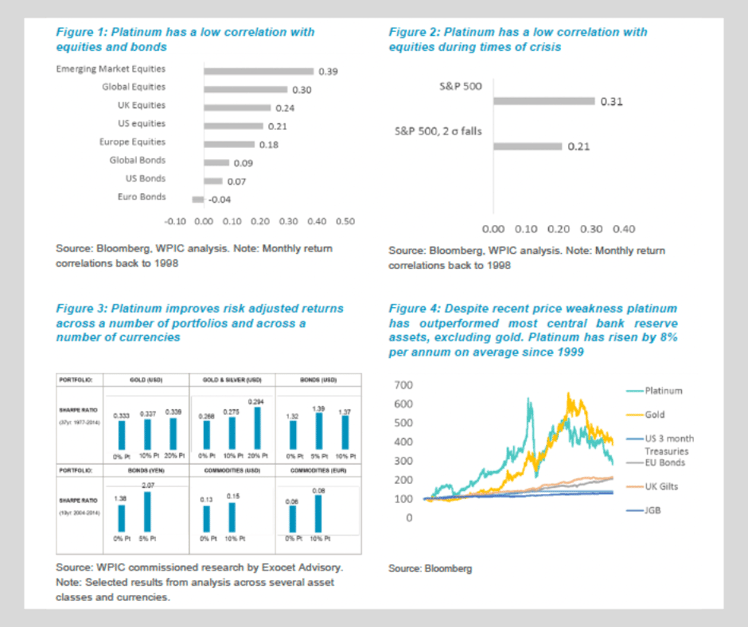

Gold’s inclusion in central bank reserves is widespread and long-standing. If a small portion of platinum is added to, or supplemented for, gold the risk adjusted returns improve

Platinum qualifies as a reserve asset and improves central bank portfolios:

-

Platinum satisfies the criteria for its inclusion as a central bank reserve asset, WPIC believes. Platinum provides typical central bank assets with similar diversifying benefits to that of gold.

-

The inclusion of platinum in a typical central bank portfolio improves risk adjusted returns and enhances recovery from stress events.

-

Platinum is adequately liquid to qualify as a reserve asset. Liquidity in platinum is the result of physical investments in Platinum and also trade in the London OTC spot market, the NYMEX and TOCOM futures exchanges and in global ETF markets.

The reasons platinum improves performance of central bank assets include:

-

Platinum has a low correlation with equities and bonds (see Figure 1).

-

Platinum has a low correlation with equities during times of crisis (see Figure 2).

-

Platinum improves risk adjusted returns across a number of portfolios and across a number of currencies (see Figure 3).

-

Platinum returns from 1999 have outperformed reserve assets other than gold despite recent price weakness. Platinum has risen by 8% per annum on average since 1999 (see Figure 4).