Fed's $29 Billion Emergency Cash Injection: Is Trouble On The Way?

The Federal Reserve just made a big move, and hardly anyone noticed.

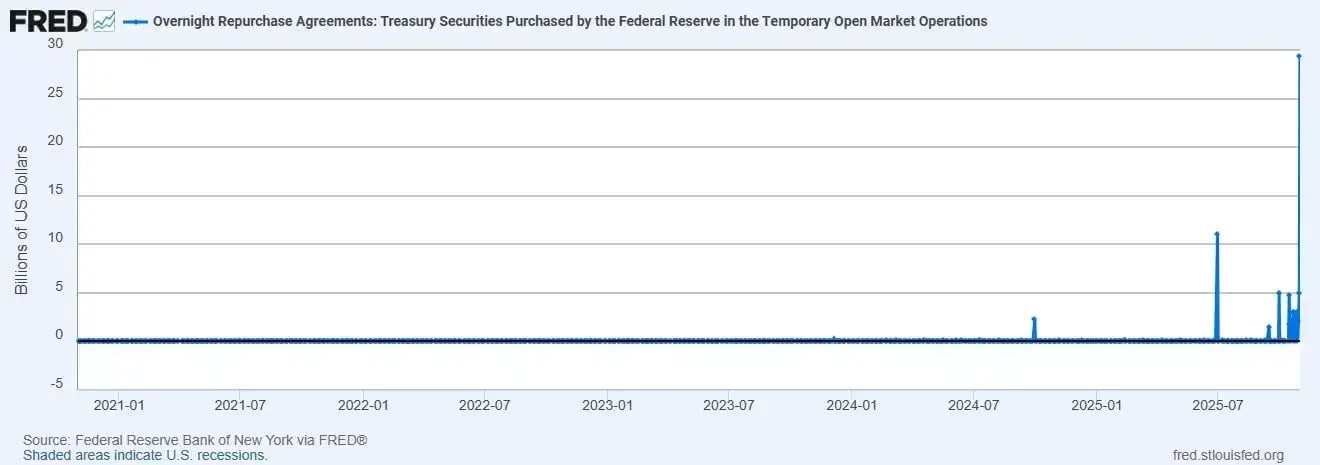

On October 31st, the Fed pumped $29.4 billion into the banking system through overnight repurchase operations. This is the largest liquidity injection in over 5 years.

In fact, the last time we saw an intervention of this magnitude was during the early days of the pandemic in 2020, when the entire financial system was on the brink of collapse.

So what is the Fed up to?

Well, the official explanation is that they're simply managing short-term funding pressures. But when you look beneath the surface, a more troubling picture emerges.

U.S. bank reserves have crashed to $2.8 trillion, their lowest level in four years. That's a decline of roughly $102 billion in recent weeks alone.

When reserves fall this quickly, liquidity dries up. Funding markets tighten. And banks, especially smaller regional institutions, start scrambling for cash.

Understanding Bank Reserves: What This Really Means

Bank reserves are essentially the cash that banks keep on hand at the Federal Reserve. Think of it like your checking account balance, except it's for banks.

When reserves are high, banks have plenty of cash to lend, to meet withdrawal demands, and to handle day-to-day operations smoothly. When reserves drop too low, banks get nervous. They start hoarding cash instead of lending it. The whole system gets tight.

For the past two years, Fed Chair Jerome Powell has been standing at podiums telling everyone that the Fed is committed to fighting inflation with higher interest rates and tighter monetary policy. The message has been clear: we're keeping things restrictive, we're draining money out of the system, and we're not backing down.

But on October 31st, while most Americans were getting ready for Halloween, the Fed did the exact opposite. They injected nearly $30 billion into the banking system overnight. That's not tightening. That's emergency support. And they did it quietly, without press conferences or explanations, hoping most people wouldn't connect the dots.

What Are Repo Operations and Why Do They Matter?

This is what we call a repo operation, short for repurchase agreement.

Here's how it works in simple terms: banks bring their Treasury bonds to the Fed and say, "We need cash right now." The Fed says, "Okay, we'll give you cash today, and you give us those bonds as collateral. Tomorrow, you buy them back."

It's essentially an overnight loan that pumps immediate cash into the banking system.

Why would banks need this? Because they're running low on reserves and they need cash to keep operating. It's a sign that the plumbing of the financial system is under stress.

According to Reuters, banks also tapped the Fed's Standing Repo Facility in record numbers on the same day, with usage reaching unprecedented levels amid month-end pressures. This dual action, both the traditional repo operations and the emergency facility usage, paints a picture of a banking system under significant strain.

And here's the part that should really get your attention. The Fed's actions and their words are completely contradicting each other. Powell keeps talking tough about inflation and restrictive policy, but behind the scenes, they're propping up the system with emergency cash injections.

When what the Fed says and what the Fed does don't match up, that's usually a sign that something is seriously wrong.

The Root Causes: Why Is This Happening Now?

So what's causing this pressure in the first place?

First, the U.S. Treasury Department is issuing massive amounts of new debt to fund government spending. Every time they issue new Treasury bonds, it sucks cash out of the banking system because investors and banks have to use their reserves to buy those bonds.

Second, the Fed has been running what's called quantitative tightening, which is just a fancy way of saying they've been shrinking their balance sheet and pulling money out of the system. They've reduced it from nearly $9 trillion in 2022 down to about $6.58 trillion today.

Put those two forces together, draining reserves through quantitative tightening and draining reserves through massive Treasury issuance, and you get exactly what we're seeing now. A liquidity squeeze. Banks don't have enough cash on hand, and the Fed is being forced to step in and provide emergency support just to keep things running.

As CNBC reported, current trends suggest a decline in demand for Treasuries from traditional big buyers, namely banks, the Fed, and foreign central banks, whose custody holdings of U.S. Treasuries recently hit their lowest level in 13 years.

The result has been an expanded role for leveraged players who will ultimately have to fund these new Treasury positions in the repo market, elevating demand at the exact time repo liquidity and reserves are growing scarcer.

Market Reactions Tell the Real Story

The day after the Fed's injection, short-term Treasury yields dropped from 3.76% to 3.72%.

That might not sound like much, but in the world of overnight funding, it's significant. It means the cash injection worked. It eased the immediate pressure. But it's only temporary. It's a band-aid, not a cure.

The Fed has already announced they're ending their balance sheet runoff on December 1st. That's Fed-speak for "we're stopping quantitative tightening because we can't afford to drain any more liquidity from the system." They're quietly backing away from their tough talk because they know the system can't handle it.

Some analysts are calling this a stealth pivot. Others are calling it a quiet bailout. Either way, it's a clear signal that the financial system is more fragile than officials want to admit.

And when the central bank has to inject billions of dollars just to keep the lights on, that should tell you something about the foundation of our economy.

Historical Context: We've Been Here Before

This isn't the first time we've witnessed emergency Fed interventions. The September 2019 repo market crisis saw overnight lending rates spike unexpectedly due to a shortage of reserves, forcing the Fed to intervene with immediate liquidity injections.

The COVID-19 pandemic in 2020 required unprecedented emergency lending facilities to prevent a global dollar liquidity squeeze.

More recently, the 2023 banking crisis that saw the failures of Silicon Valley Bank and Signature Bank highlighted vulnerabilities stemming from rising interest rates and unrealized losses on bank bond portfolios.

Each of these events required the Federal Reserve to step in as the lender of last resort. And each time, it revealed underlying weaknesses in the financial system that most Americans never see until it's too late.

What This Means for Your Retirement Savings

Your 401(k), your IRA, your TSP, your brokerage account - they're all tied to this same system.

When the Fed has to step in with emergency operations, when bank reserves are crashing, when liquidity is drying up, all of those paper assets are at risk. Stocks depend on a functioning financial system. Bonds depend on confidence in government debt.

Even the cash sitting in your savings account depends on the banking system staying stable.

But gold doesn't depend on any of that.

Gold doesn't need the Federal Reserve to inject liquidity. It doesn't need confidence in the banking system. It doesn't need the government to keep its promises.

Gold is a physical asset that holds value regardless of what's happening in the financial system. And that's precisely why it's been the ultimate form of wealth preservation for thousands of years.

Why Central Banks Are Buying Gold at Record Levels

Look at what central banks around the world are doing. They're not buying more Treasury bonds. They're buying gold.

In 2024 alone, global central banks added over 1,000 tons of gold to their reserves.

They're doing this because they see the same warning signs you're seeing right now. Unsustainable debt levels, falling reserves, and a Federal Reserve that's running out of options.

Think about that for a second. The people who run the world's financial systems, the ones with access to all the data and all the inside information, are buying gold at record levels.

They're preparing. And if they're preparing, shouldn't you be too?

The Bigger Picture: Multiple Threats to Dollar Stability

This isn't about fear or doom and gloom. It's about recognizing reality and taking practical steps to protect what you've worked your entire life to build.

The Fed's $29 billion injection isn't a one-time event. It's a symptom of deeper problems that have been building for years:

- Rising national debt that's now approaching $36 trillion

- Endless government spending with no plan to pay for it

- A dollar being challenged as the world's reserve currency

- A central bank trapped between controlling inflation and preventing a financial crisis

Every one of those factors makes the case for owning gold stronger.

Because gold is the one asset that doesn't depend on the system working perfectly. It doesn't require the Fed to make the right decisions. It doesn't need politicians to balance the budget. It just needs to exist, and it will hold value.

Gold as Portfolio Protection: A Practical Approach

For Americans with retirement savings, this is the moment to ask yourself a serious question. How much of your wealth is tied to a system that requires emergency interventions just to stay functional? And what happens to that wealth if the next intervention isn't enough?

Gold offers a different path. It's not about abandoning your other investments. It's about diversification and protection. It's about having a portion of your wealth in something that:

- Doesn't disappear when liquidity dries up

- Doesn't lose value when the dollar weakens

- Doesn't depend on the Federal Reserve's ability to keep juggling all these problems at once

The information is out there if you know where to look. The Fed's own data shows reserves crashing. The repo operations are public record.

The contradictions between their words and their actions are obvious once you see them. Most people just aren't paying attention.