Gold Outperforms Bonds For First Time Since 1979 - 3 Charts You Need To See

Something remarkable happened recently that most investors completely missed.

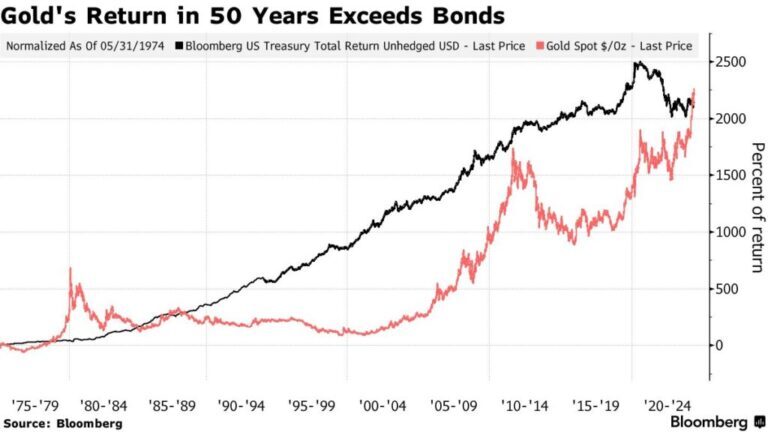

For the first time since 1979, gold has risen high enough to exceed the return on bonds over the last 50 years. This isn't just another market fluctuation. We're witnessing a fundamental shift in how traditional assets are performing, and the implications are massive.

If you have money in a 401k, IRA, TSP, or other retirement accounts heavily weighted toward bonds and stocks, understanding what's happening right now could be the difference between preserving your wealth and watching it erode over the next decade.

Understanding the Traditional Relationship Between Gold and Interest Rates

For decades, financial advisors have taught the same lesson about gold: it has an inverse relationship with interest rates and Treasury bonds.

When the Federal Reserve raises rates, gold typically goes down or stays flat. When bond prices rise, gold should fall. This relationship has been a cornerstone of portfolio theory for as long as most investors can remember.

Why Gold Usually Falls When Interest Rates Rise

The logic is straightforward. Gold doesn't pay interest or dividends. When interest rates rise, bonds and savings accounts become more attractive because they offer guaranteed returns.

Investors typically rotate out of non-yielding assets like gold and into interest-bearing instruments. This dynamic has played out consistently through multiple economic cycles.

What Changed After the Pandemic Money Printing

Except something fundamentally different happened after the unprecedented monetary expansion during the COVID-19 pandemic.

When Jerome Powell and the Federal Reserve started raising interest rates in 2022, committed to reducing the Fed's balance sheet and engineering a soft landing for the economy, gold did something it wasn't supposed to do.

It went up. And it kept going up.

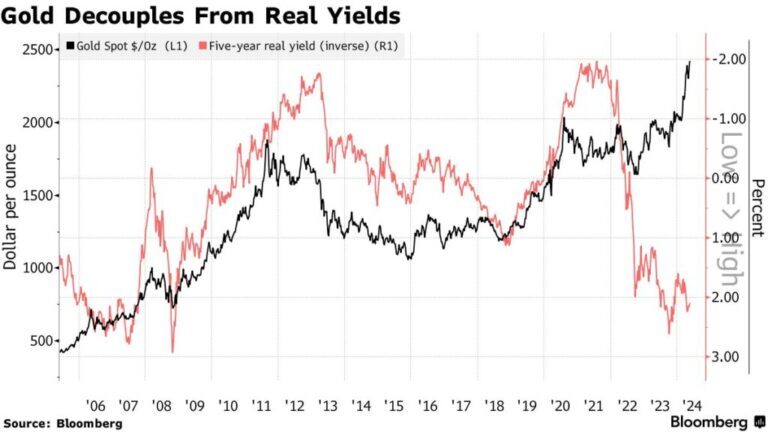

This is called "decoupling" from real yields, as shown in the chart:

That was the first signal that this time was different.

Gold was telling us that the old playbook wasn't working anymore because the debt-driven economy had reached a breaking point.

While the Federal Reserve was raising rates at the fastest pace in decades, gold prices were climbing, defying the traditional inverse relationship that had held for generations.

This decoupling wasn't a temporary anomaly. It was the market's way of signaling that something fundamental had changed in the global financial system.

Gold Exceeds 50 Years of Bond Returns: A Historic Milestone

Two years after gold began its unexpected rise during the rate-hiking cycle, something truly historic happened. Gold had risen high enough to exceed the return on bonds over the last 50 years.

Why is this such big news? Because "50 year bond returns" have been the bedrock of conservative retirement portfolios for generations.

That bedrock belief has just been shattered by gold.

The last time gold exceeded long-term bond returns was 1979, during a period of stagflation and economic turmoil. But the circumstances today are vastly different and arguably more concerning.

In 1979, the United States still had the petrodollar system firmly in place. We had the economic strength and military might to fight wars and maintain global empire. The dollar's dominance was unquestioned, and America's debt levels were manageable.

Today, with over $38 trillion in national debt and climbing, that playbook is gone.

The petrodollar system is over as countries like China, Russia, and Saudi Arabia have been trading in non-US currency since March 2025.

The economic foundation that supported the post-1979 recovery simply doesn't exist anymore.

Gold vs. S&P 500: The 25-Year Performance Gap

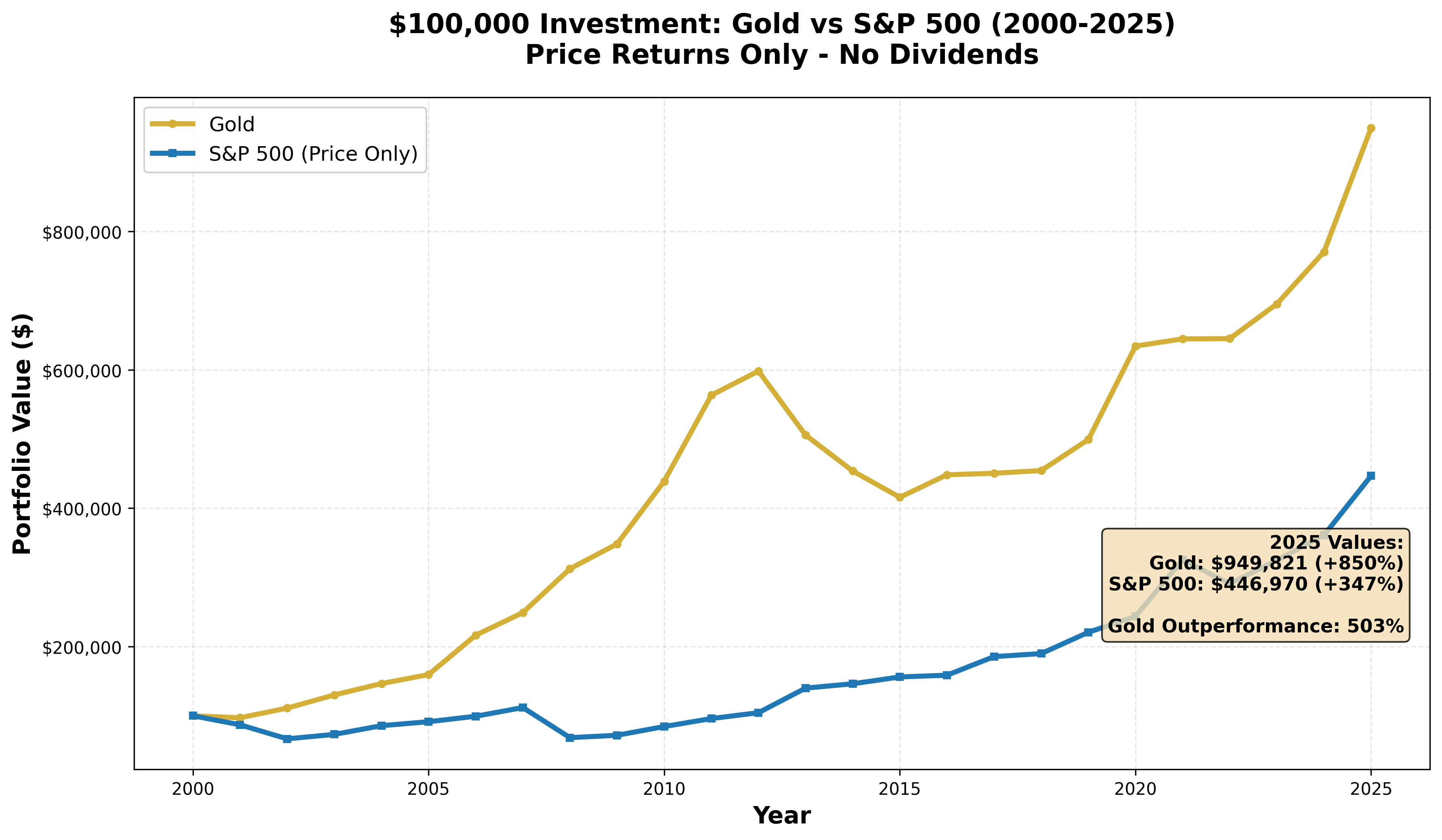

While the bond market story is compelling, the stock market comparison is equally revealing.

Gold has been outperforming the S&P 500 since 2000, beating it by over 500 percentage points over the last 25 years.

If you had invested $100,000 in gold in 2000, your investment would be worth approximately $950,000 today. An 850% return.

That same $100,000 invested in the S&P 500 (price returns only, excluding dividends) would be worth about $447,000. A 347% return.

While everyone was chasing tech stocks, riding market highs, and trusting that equities would always deliver superior long-term returns, gold was quietly doing what it has always done throughout history. It was preserving and growing wealth in a way that doesn't depend on corporate earnings, Federal Reserve policy, or the whims of Wall Street.

Why Most Investors Missed This

The financial services industry has a vested interest in keeping investors focused on stocks and bonds. Mutual funds, ETFs, and managed portfolios generate fees. Gold held in physical form or in a self-directed IRA doesn't generate ongoing management fees for Wall Street.

Additionally, the narrative around gold has been deliberately marginalized. Gold investors have been called "gold bugs," doomsayers, and pessimists.

The mainstream financial media has consistently downplayed gold's role in a modern portfolio, even as the data clearly shows its superior performance over the past quarter century.

What Gold Is Telling Us About the Economy

Gold doesn't lie. It can't be manipulated by corporate accounting, earnings guidance, or Federal Reserve press conferences.

Gold acts as a truth teller about the real state of the monetary system.

The Debt Crisis No One Wants to Discuss

The United States national debt has surpassed $38 trillion and continues to grow at an accelerating pace. Interest payments on this debt now exceed $1 trillion annually. For the first time in history, we're spending more on debt interest than our entire defense budget!

This is clearly unsustainable, and gold's performance is reflecting that reality.

When governments accumulate debt they can never realistically repay, there are only three options:

- Default - Politically unacceptable for a reserve currency nation

- Austerity - Politically impossible in a democracy where voters demand services

- Inflation - The path of least resistance, where the debt is repaid in devalued currency

Gold's rise is telling us that option three is already underway, regardless of what official inflation statistics claim.

The Debasement of the Dollar

Every dollar printed dilutes the value of every dollar already in circulation.

Since 2000, the Federal Reserve's balance sheet has expanded from under $600 billion to over $7 trillion at its peak. The M2 money supply has more than quadrupled.

Your retirement savings, denominated in dollars, have been systematically debased. Even if your account balance has grown, the purchasing power of those dollars has declined significantly.

Gold's outperformance is simply reflecting this monetary reality.

Why Central Banks Are Buying Gold at Record Levels

Perhaps the most telling indicator of gold's importance is what central banks are doing. These institutions have access to economic data, modeling, and intelligence that retail investors will never see. And they're buying gold at record levels.

Central Banks Now Hold More Gold Than Treasury Bonds

According to recent data, central banks around the world now hold more gold than U.S. Treasury bonds. This represents a seismic shift in how sovereign nations are managing their reserves.

China, Russia, India, Turkey, and Poland have been aggressive buyers of gold over the past decade. Even countries traditionally aligned with the United States are diversifying away from dollar-denominated assets and into physical gold.

Just look at Japan - they've been our biggest foreign buyer of debt for decades, practically financing America through the yen carry trade. And now they're dumping trillions in US Treasury bonds.

What Central Banks Know That You Don't

Central banks understand that the current monetary system is reaching its limits. They see the debt levels, the political gridlock, the inability to control spending, and the geopolitical challenges to dollar dominance.

They're protecting their nations' wealth the same way individuals should be protecting their retirement savings.

When the institutions that literally create money are buying gold, that should tell you everything you need to know about where this is headed.

The Geopolitical Dimension: Challenges to Dollar Dominance

The dollar's role as the world reserve currency has been a cornerstone of American economic power since World War II. But that dominance is being challenged in ways that would have been unthinkable just a decade ago.

The BRICS Nations and De-Dollarization

The BRICS nations (Brazil, Russia, India, China, and South Africa) have been actively working to reduce their dependence on the U.S. dollar for international trade.

They're past exploring alternative payment systems. They're already using them, and bypassing the dollar through bilateral trade agreements in local currencies.

And since BRICS now represents almost 40% of the world's GPD, this is a big deal.

What Happens When the Dollar Loses Reserve Status

If the dollar loses its reserve currency status, or even if that status is significantly diminished, the implications for American savers are profound.

The demand for dollars would decline, potentially triggering significant devaluation. Import prices would soar. The standard of living for Americans would decline as cost of living skyrockets.

Gold, as a non-sovereign store of value, would be one of the few assets that could preserve purchasing power through such a transition.

The Coming Monetary Reset

We're not at the end of this story yet. We're somewhere in the middle, watching a transition happen in real time.

This is a transition away from a purely fiat-based monetary system toward something that will inevitably involve gold backing in some form.

Historical Precedent for Monetary Resets

Throughout history, every fiat currency system has eventually failed.

The U.S. dollar has been a pure fiat currency since 1971, when President Nixon closed the gold window, ending the Bretton Woods system. We're now over 50 years into this experiment with a purely fiat dollar.

Previous monetary resets have always involved a return to some form of hard money backing, whether gold, silver, or other tangible assets.

The signs suggest we're approaching another such reset.

What a Gold-Backed System Might Look Like

A new monetary system doesn't necessarily mean a return to the classical gold standard where currencies are directly redeemable for gold. It might involve:

- Central bank digital currencies (CBDCs) with partial gold backing

- International trade settlements using gold-backed instruments

- A multi-polar reserve system where gold serves as the neutral settlement asset

- Regional currency blocs with varying degrees of commodity backing

Regardless of the specific structure, gold will play a central role in whatever system emerges from the current crisis.

What This Means for Your Retirement Savings

If you're age 55 or older with retirement savings in traditional accounts, these trends should be deeply concerning.

The assets that financial advisors have told you to hold—stocks, bonds, and cash—are all showing signs of systemic weakness.

The Risk of Traditional 60/40 Portfolios

The classic 60/40 portfolio (60% stocks, 40% bonds) has been the gold standard of retirement planning for decades. But this allocation assumes that bonds provide stability and income while stocks provide growth. When both asset classes are vulnerable to the same underlying problem—dollar debasement and unsustainable debt—the diversification benefit disappears.

The cracks in this model have become so apparent that in September 2025, Morgan Stanley's Chief Investment Officer Mike Wilson made a groundbreaking recommendation: a 60/20/20 portfolio allocation.

That's 60% equities, 20% bonds, and 20% gold.

This marks the first time Morgan Stanley has ever recommended such a significant allocation to gold, effectively giving gold the same weighting as bonds in one of Wall Street's most influential portfolio models.

Wilson's rationale is straightforward: bonds have lost their traditional safe-haven status amid persistent inflation, unsustainable debt levels, and unconventional central bank policies. He describes gold as the new "anti-fragile" asset, capable of thriving in volatile conditions.

When one of the world's most prestigious investment banks abandons the 60/40 model that has dominated financial planning for generations, it's a clear signal that something fundamental has changed in the financial system.

Why "Time in the Market" May Not Save You

The traditional advice is that long-term investors should stay the course, that time in the market beats timing the market. This advice is sound during normal economic cycles.

But we're not in a normal cycle.

We're in a period of monetary transition that happens perhaps once or twice per century.

Staying fully invested in dollar-denominated paper assets during a currency crisis is not prudent diversification. It's concentrated risk.

How to Protect Your Retirement with Gold

The good news is that protecting your retirement savings with gold is straightforward, and you don't have to liquidate your entire portfolio to gain meaningful protection.

Gold IRA: The Tax-Advantaged Approach

A Gold IRA allows you to hold physical precious metals within a tax-advantaged retirement account. You can roll over funds from an existing 401k, traditional IRA, or other qualified retirement plan into a self-directed IRA that holds physical gold, silver, platinum, or palladium.

The tax treatment is identical to a traditional IRA—contributions may be tax-deductible, growth is tax-deferred, and distributions are taxed as ordinary income. The only difference is that your wealth is stored in physical precious metals rather than paper assets.

How Much Gold Should You Hold?

Financial experts typically recommend allocating between 5% and 20% of your portfolio to precious metals, depending on your risk tolerance and economic outlook. Given the current environment, many advisors are recommending allocations toward the higher end of that range.

The key is that gold serves as insurance. You don't need your entire portfolio in gold, but you need enough to protect your purchasing power if the dollar-denominated assets decline significantly.

Physical Gold vs. Gold ETFs

While gold ETFs offer convenience and liquidity, they come with counterparty risk. You don't actually own physical gold—you own shares in a fund that claims to hold gold. In a systemic crisis, there's no guarantee you'll be able to redeem those shares for physical metal.

Physical gold held in your possession or in a secure, allocated storage facility eliminates counterparty risk. You own the actual metal, not a promise to deliver metal.

Common Objections to Gold Investing (And Why They're Wrong)

Despite gold's clear performance advantage, many investors still resist adding it to their portfolios.

Let's address the most common objections.

"Gold Doesn't Pay Dividends or Interest"

This is true, but it misses the point. Gold's purpose isn't to generate income, it's to preserve purchasing power.

When your bonds are losing value in real terms and your dividend-paying stocks are declining, gold's lack of yield becomes irrelevant. Capital preservation is more important than yield when the capital itself is at risk.

"Gold Is Too Volatile"

Gold can be volatile in the short term, but over longer periods, it's actually less volatile than stocks and provides better downside protection.

During the 2008 financial crisis, gold held its value while stocks crashed. During the 2020 pandemic panic, gold surged while markets tumbled.

"The Government Could Confiscate Gold Again"

The 1933 gold confiscation under FDR is often cited as a reason not to own gold. But the circumstances today are completely different.

In 1933, the dollar was backed by gold, and the government needed gold to maintain the monetary system. Today, the dollar is fiat, and there's no monetary reason for confiscation.

Additionally, gold confiscation would be politically and practically impossible in today's environment. It would trigger massive capital flight and destroy any remaining confidence in the dollar.

"I've Missed the Run-Up, It's Too Late Now"

Gold has risen significantly over the past 25 years, but we're still in the early stages of the monetary transition. Gold would need to reach approximately $20,000 per ounce just to match the total expansion of the money supply since 2000.

That's why most major banks are forecasting that gold will rise to somewhere in between $5,000 and $6,000 per ounce in 2026. And some are predicting it could see $10,000/ounce by 2030.

More importantly, gold's role as insurance doesn't depend on further price appreciation.

Even if gold simply maintains its current purchasing power while paper assets decline, you've protected your wealth.

Protect Your Retirement with National Gold Group

You have a choice to make. You can continue holding paper assets that are showing clear signs of weakness, or you can do what central banks, financial institutions, millionaires and billionaires around the world are doing...

And move a portion of your retirement savings into the one asset that has preserved wealth for over 5,000 years.

The data is clear. The trends are unmistakable. The warning signals are flashing.

Gold has exceeded 50-year bond returns for the first time since 1979. Gold has outperformed the S&P 500 by over 500 percentage points since 2000. Central banks are buying gold at record levels while reducing their Treasury holdings.

This isn't speculation or fear-mongering. This is simply reading the market signals and understanding what they mean for your financial future.

The question isn't whether you can afford to invest in gold.

The question is whether you can afford not to.