Labor Market Hits Breaking Point: Unemployment Exceeds Job Openings

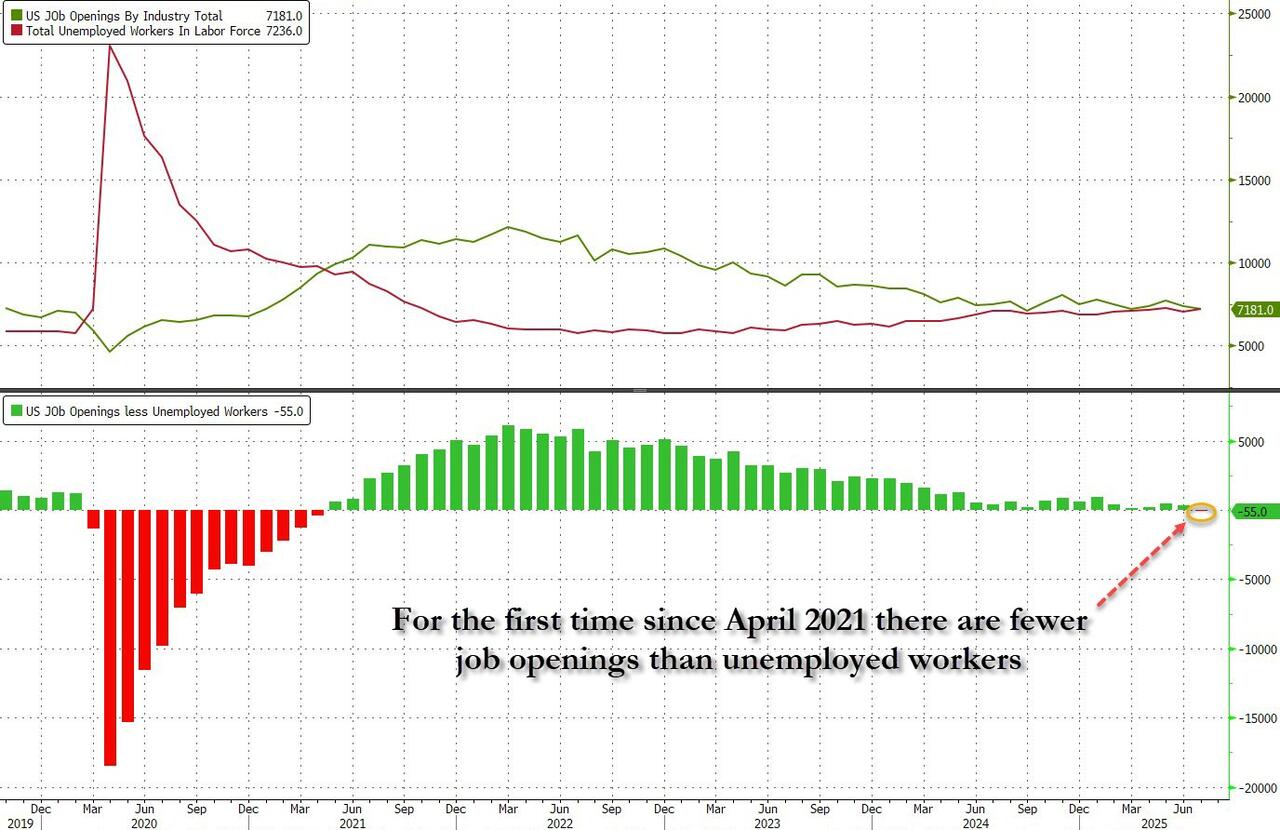

The American labor market just crossed a threshold that hasn't been seen since April 2021, and the implications for the broader economy could be profound.

For the first time in over three years, there are now more unemployed Americans than available job openings, marking a fundamental shift from a supply-constrained to a demand-constrained labor market.

Job Openings Plummet to Near-COVID Lows

The Bureau of Labor Statistics released its July Job Openings and Labor Turnover Survey (JOLTS) data, revealing that job openings tumbled by 176,000 to 7.18 million. This figure came in well below economist expectations of 7.38 million and represents the second-lowest level since the COVID-19 economic crash.

The decline wasn't isolated to a single sector. Health care and social assistance saw the largest drop with 181,000 fewer openings, while arts, entertainment, and recreation lost 62,000 positions. Even mining and logging shed 13,000 job opportunities.

Perhaps most telling was the collapse in government job openings, which crashed to pre-COVID levels as demand for public sector positions has essentially evaporated.

The Supply-Constrained to Demand-Constrained Shift

This transition represents more than just statistical noise. In June, the labor market maintained 342,000 more job openings than unemployed workers, keeping it in supply-constrained territory. By July, that dynamic had completely reversed, with 55,000 fewer job openings than unemployed Americans seeking work.

Historical data shows that the United States has never entered a recession during periods when job openings exceeded unemployed workers.

The labor market crossing back into demand-constrained territory removes this protective buffer and suggests the economy may be more vulnerable to broader economic pressures.

What This Means for Economic Stability

The ratio of job openings to unemployed workers has now dropped below 1.0x for the first time since the early stages of the economic recovery from COVID-19. This metric serves as a crucial indicator of labor market health and economic momentum.

When fewer jobs are available than people seeking work, it typically signals weakening business confidence, reduced consumer spending power, and potential deflationary pressures.

Companies become more selective in hiring, workers have less bargaining power for wages, and overall economic growth tends to slow.

Federal Reserve Policy Implications

This labor market deterioration comes at a critical time for Federal Reserve policy decisions. With the central bank having maintained elevated interest rates to combat inflation, a weakening job market could force policymakers to reconsider their monetary stance more aggressively than previously anticipated.

The timing is particularly significant given that comprehensive annual job data revisions are scheduled for September 9th. These revisions could reveal whether recent employment strength was overstated, potentially providing additional justification for more accommodative monetary policy.

Broader Economic Context

The labor market shift occurs against a backdrop of mounting fiscal challenges. The national debt has surpassed $33 trillion, government spending continues at unprecedented peacetime levels, and global economic uncertainties persist.

International factors add another layer of complexity. Central banks worldwide have been accumulating gold reserves at record levels, while several major economies are actively working to reduce their dependence on dollar-denominated trade.

These developments suggest growing concerns about long-term monetary stability and purchasing power preservation.

Historical Precedent and Future Outlook

Previous instances of labor market transitions from supply-constrained to demand-constrained conditions have often preceded broader economic slowdowns. While each economic cycle has unique characteristics, the pattern of weakening job availability relative to unemployment has historically served as an early warning signal.

The question now becomes how quickly this labor market deterioration will manifest in other economic indicators. Friday's August employment report may provide initial clues, but the comprehensive annual revisions in early September could reveal the full extent of underlying labor market weakness.

Protecting Wealth During Economic Uncertainty

For Americans approaching or in retirement, this labor market shift underscores the importance of diversification beyond traditional stock and bond portfolios. When economic uncertainty rises and monetary policy becomes more accommodative, assets that maintain purchasing power independent of government policy decisions become increasingly valuable.

Physical precious metals have historically served this role, maintaining value during periods of currency debasement, economic instability, and monetary policy uncertainty.

Unlike paper assets tied to corporate earnings or government promises, gold and silver represent tangible stores of value that have preserved wealth across multiple economic cycles.

The current labor market dynamics, combined with massive government debt levels and ongoing monetary policy challenges, create conditions similar to previous periods when precious metals outperformed traditional financial assets.

Looking Ahead

The crossing of this critical labor market threshold represents more than a statistical milestone. It signals a fundamental shift in economic dynamics that could influence everything from Federal Reserve policy to individual investment strategies.

As the economy navigates this transition, Americans with retirement savings in traditional accounts may want to consider how changing labor market conditions could affect their long-term financial security. The shift from a supply-constrained to demand-constrained job market historically precedes broader economic challenges that can significantly impact portfolio values and purchasing power.

Understanding these economic signals and their historical implications can help individuals make more informed decisions about protecting and preserving their wealth during uncertain times.