Morgan Stanley Says Buy Gold! Wall Street's 60/40 Portfolio Is Dead.

Morgan Stanley Breaks With Decades of Wall Street Tradition

You know something significant is happening when one of Wall Street's most prominent investment firms changes a strategy they've championed for decades.

Morgan Stanley's Chief Investment Officer, Michael Wilson, recently made waves by recommending investors shift from the traditional 60/40 portfolio to a 60/20/20 strategy that allocates 20% to gold.

For those unfamiliar, the 60/40 portfolio has been Wall Street's go-to allocation for generations: 60% in stocks, 40% in bonds. The theory was simple. Stocks perform well during economic growth, bonds provide safety during downturns, and together they balance each other out.

And it's been that way for decades. Which is why this announcement from Morgan Stanley is such a massive shift in the investment world.

What Morgan Stanley Is Telling Investors About Gold

Morgan Stanley is now telling investors to cut their bond allocation in half and replace it with gold. Their reasoning? Gold is now the "anti-fragile asset to own, rather than Treasuries."

That's a remarkable statement coming from a major Wall Street institution that has historically steered clients away from precious metals.

The Morgan Stanley gold recommendation represents more than just a tactical adjustment. It signals a fundamental reassessment of what constitutes a safe asset in today's economic environment. When a firm managing trillions in assets tells clients to allocate one-fifth of their portfolio to gold, it's worth paying attention.

Why Bonds Lost Their Safe-Haven Status

So what changed? The answer is everything.

For starters, bonds have lost their safe-haven status. During the tariff uncertainty earlier this year, something unusual happened. Gold rallied while bonds sold off. This wasn't supposed to happen.

Treasuries typically benefit during flight-to-safety environments because of America's historical financial strength. But that playbook is being rewritten in real time. America's "financial strength" isn't what it used to be, so Treasuries aren't considered as safe anymore.

It's also highly unusual for gold to rally when bond yields are rising, yet that's exactly what we've seen, underscoring the fundamental strength of gold in today's market environment.

The De-Dollarization Trend Accelerates

The reason is straightforward. Global investors are losing faith in U.S. debt. For the first time since 1996, central banks now hold more gold than U.S. Treasuries as the world continues to de-dollarize.

We talk about this a lot, but that's because it's major world economic news. Central banks, the most sophisticated financial institutions on the planet, are choosing gold over American government bonds.

According to the World Gold Council, central banks purchased over 1,000 tonnes of gold in 2023 and continued aggressive buying through 2024 and into 2025. This isn't speculation or market timing, it's a strategic shift in how sovereign nations view monetary reserves.

Countries like China, Russia, India, and Turkey have been leading this charge, diversifying away from dollar-denominated assets and into physical gold. When the institutions responsible for managing national wealth make this move, individual investors should take notice.

The U.S. Debt Crisis Driving the Morgan Stanley Gold Recommendation

This makes perfect sense when you consider the fiscal trajectory we're on. The U.S. national debt now stands at $37 trillion as of this month, and there's no indication the borrowing will slow down.

Over the past year alone, the debt increased by $2.17 trillion. That's $5.96 billion per day, $248.27 million per hour, or $68,964 per second.

The cumulative deficit for fiscal year 2025 reached $2 trillion by August, driven by rising Social Security, Medicare, and Medicaid payments, along with ballooning interest costs on the debt itself.

Interest Payments Now Exceed Defense and Medicare Spending

Interest payments on the national debt have now surpassed spending on both Medicare and national defense. That means we're spending more money servicing our debt than we are on healthcare or protecting the country.

This creates a vicious cycle. As debt grows, interest payments increase, requiring more borrowing, which leads to higher interest payments, and so on. There's no clear path to fiscal sustainability under current policies, regardless of which political party controls Washington.

As one analyst put it earlier this year, the sagging demand for U.S. Treasuries represents "red lights blinking." The bond market is sending a clear message that government spending is out of control and the reserve currency privilege America has enjoyed for 80 years is running out.

Why This Represents a Seismic Shift in Investing

This is why Morgan Stanley's pivot matters so much. A major investment firm abandoning the venerable 60/40 portfolio represents what one financial publication called a "seismic shift" in the investing world.

For years, mainstream advisors have spurned gold, often viewing it through a short-term price lens rather than as monetary insurance. But we're reaching a point where even the mainstream players can't ignore reality.

Understanding the 60/20/20 Portfolio Strategy

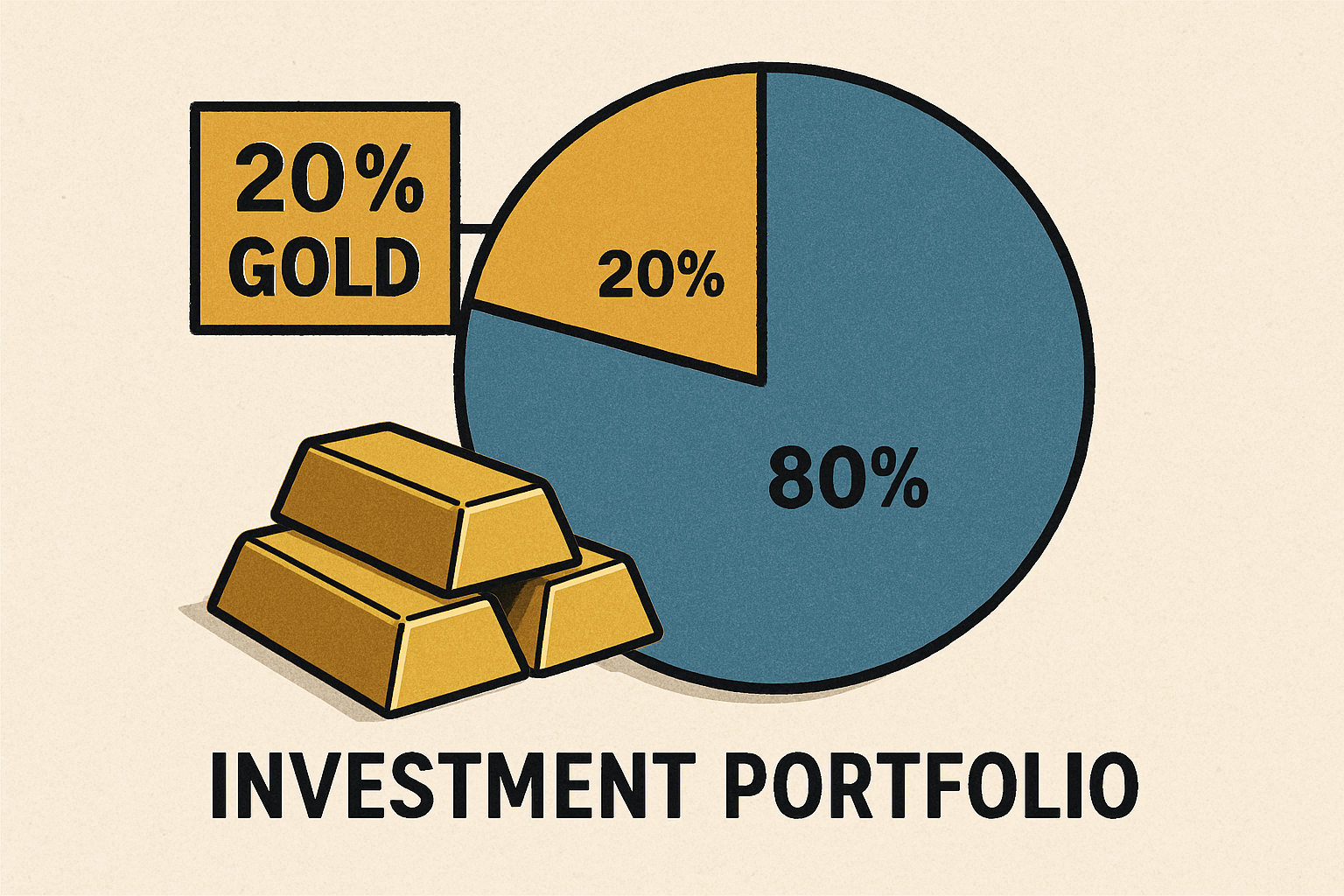

The Morgan Stanley gold recommendation specifically calls for a 60/20/20 allocation:

- 60% in equities - Maintaining exposure to economic growth and corporate earnings

- 20% in bonds - Reduced from the traditional 40%, acknowledging bonds' diminished safe-haven status

- 20% in gold - The new allocation, serving as an inflation hedge and portfolio stabilizer

This isn't about abandoning stocks or completely exiting bonds. It's about recognizing that the economic environment has fundamentally changed, and portfolio construction needs to adapt accordingly.

Gold's role in this allocation is to provide what Morgan Stanley calls "anti-fragility", an asset that not only preserves value during crises but can actually benefit from the very conditions that damage traditional financial assets.

What Investing in Gold Means for Retirement Planning

For those focused on retirement planning, the Morgan Stanley gold recommendation carries particular weight. Retirees and near-retirees can't afford to wait out extended market downturns or recover from inflation-driven purchasing power losses.

Gold's Performance During Economic Uncertainty

Bottom line, the fiat system is getting shaky. And everyone sees it, despite the mainstream media trying to hide it.

Gold has already gained more than 87% since January 2024, and the policies driving this rally aren't going away anytime soon. Rising national debt, geopolitical uncertainty, central banks buying gold in record quantities, countries challenging the dollar as the world reserve currency, and rampant government spending all point in the same direction.

Unlike stocks, which require economic growth and corporate profitability, or bonds, which depend on government creditworthiness, gold derives its value from scarcity and its 5,000-year history as a store of wealth. When confidence in paper currencies and government debt wavers, gold typically strengthens.

The Institutional Shift Toward Gold

As one market analyst noted, "Morgan Stanley just blinked. Gold now has a real seat at the table." Of course we believe that gold's always had a seat at the table, in fact sits at the head of the table. But when a giant like Morgan Stanley makes this type of announcement, it could lead to a broader institutional shift in strategy.

Nobody likes to go first. Not in markets, not in startups, not in fashion. But once the ice breaks, the floodgates can open. Morgan Stanley broke the 60/40 rule, and now capital is tilting toward gold.

When institutional investors begin allocating to gold in meaningful percentages, it creates sustained demand that individual investors can benefit from by positioning ahead of the crowd.

How to Implement the Morgan Stanley Gold Recommendation

For individual investors considering investing in gold as part of their retirement planning, there are several approaches to achieving the recommended 20% allocation:

Physical Gold

Owning physical gold in the form of coins or bars provides direct ownership without counterparty risk. Popular options include American Gold Eagles, Canadian Gold Maple Leafs, and gold bars from recognized refiners.

Gold IRAs

For retirement accounts, a Gold IRA allows you to hold physical precious metals within a tax-advantaged structure. This enables you to implement the Morgan Stanley gold recommendation within your existing retirement strategy without triggering taxable events.

Timing Your Gold Investment

This monetary malfeasance can't be voted away. The best thing you can do is prepare and shield yourself from the inevitable consequences. That's why even in the midst of record highs, Morgan Stanley is making this announcement now. Because they know gold's just getting started.

Many investors hesitate to buy gold after significant price increases, fearing they're "buying at the top." However, the Morgan Stanley gold recommendation wasn't issued during a gold market correction; it came after substantial gains, suggesting the firm believes the fundamental drivers remain intact regardless of current price levels.

The Long-Term Case for Gold in Your Portfolio

Whether other mainstream advisors follow Morgan Stanley's lead or not, the message is clear. If you haven't already, it's time to consider rebalancing your portfolio to include gold.

The economic dynamics that have pushed gold to record highs aren't temporary. They're structural. And they're accelerating.

Structural Factors Supporting Gold

Several long-term trends support the case for investing in gold as part of retirement planning:

Persistent Inflation Pressures - Despite central bank efforts, inflation remains elevated compared to the 2010s, eroding the purchasing power of cash and fixed-income investments.

Geopolitical Fragmentation - Increasing tensions between major powers, regional conflicts, and the fracturing of the post-Cold War global order create ongoing uncertainty that benefits safe-haven assets.

Currency Debasement - With major economies running persistent deficits and central banks maintaining accommodative policies, fiat currencies face long-term devaluation pressures.

Demographic Pressures - Aging populations in developed economies will strain government finances through increased healthcare and pension obligations, likely leading to more debt and currency creation.

Technology and Monetary Experimentation - While digital currencies and financial innovation create opportunities, they also introduce uncertainties that make time-tested stores of value more attractive.

Taking Action on the Morgan Stanley Gold Recommendation

At National Gold Group, our mission is to inform and educate Americans about investing in gold and other precious metals. And present you with no-pressure options that are unique to your goals.

With over 25 years of experience and a 4.9 rating across multiple 3rd party review sites like Trustpilot and Google, we're here to help you with transparent and no-hassle advice.

The Morgan Stanley gold recommendation validates what precious metals advocates have been saying for years: gold deserves a meaningful place in diversified portfolios, especially for those focused on retirement planning and wealth preservation.