The Cantillon Effect: The Wealth Transfer Happening Under Our Noses

For over 15 years, there's been a massive wealth transfer happening in America that's been draining people's savings, and most Americans have no idea it's even happening.

It's called the Cantillon Effect, and it explains why the wealthy elite seem to keep getting richer during our shaky economy, while the rest of us feel like it's getting harder and harder to afford a normal cost of living.

What Is the Cantillon Effect?

Coined by economist Richard Cantillon during the 18th century, the Cantillon Effect describes the unequal impact of inflation on society. This economic principle reveals how monetary policy creates winners and losers, with those closest to newly created money benefiting at the expense of everyone else.

The Cantillon Effect demonstrates that when central banks print money, it doesn't distribute evenly throughout the economy. Instead, it follows a predictable path that systematically transfers wealth from savers and wage earners to banks, corporations, and asset holders.

How Federal Reserve Money Printing Creates Wealth Inequality

Since the financial crisis of 2008, the Federal Reserve has printed approximately $8 trillion of new money through quantitative easing programs.

But where did all that money go when it was printed?

It didn't magically appear in everyone's account at the same time. That's where the Cantillon Effect explains the great wealth transfer that's been happening right under our noses.

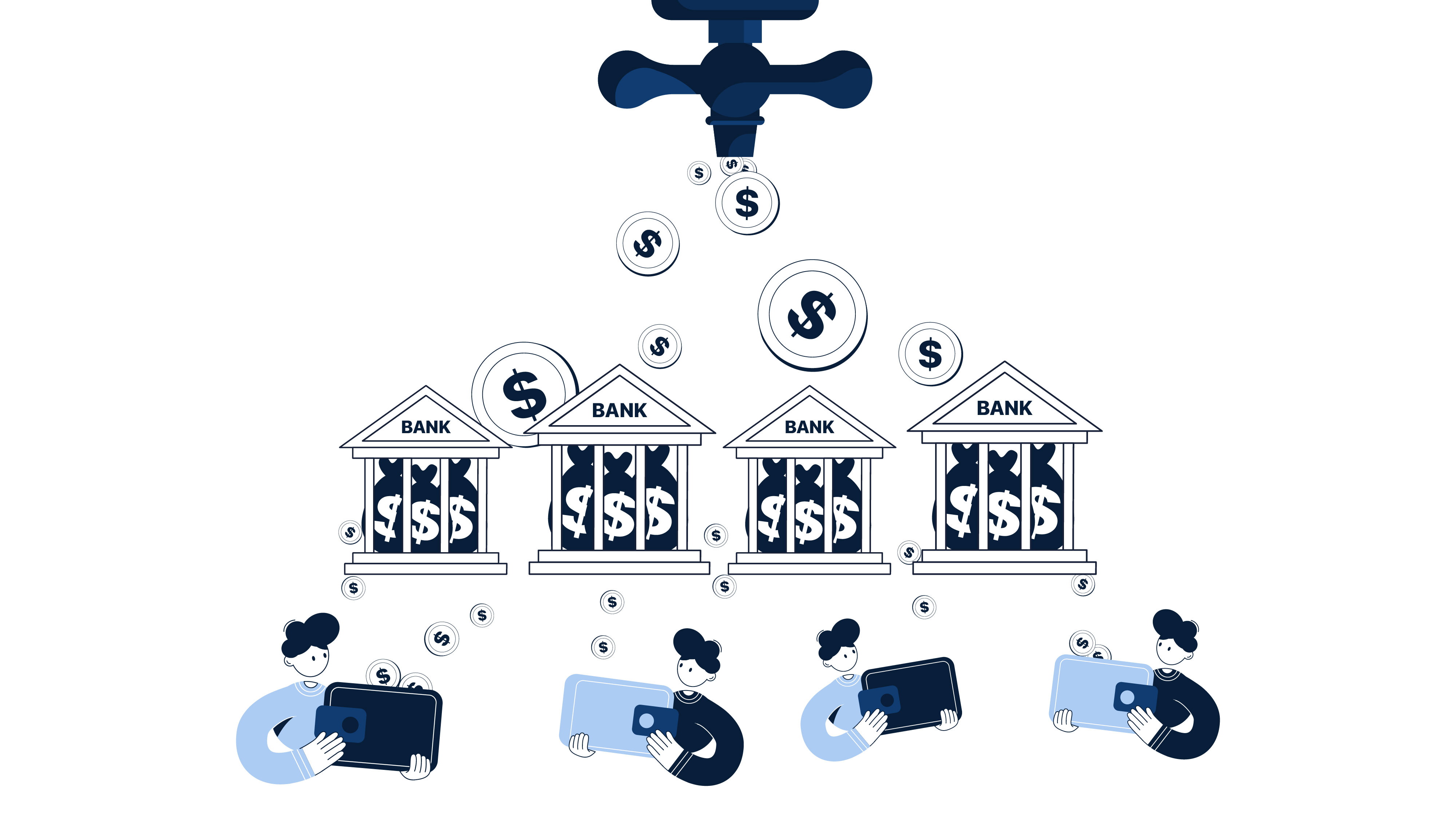

The relationship between money supply and the cost of goods is not neutral. It creates distinct winners and losers through a trickle-down process.

Here's how it works:

Step 1: Banks Receive New Money First

When the Federal Reserve creates new money through quantitative easing, it goes straight to the banking system first. Banks literally receive this fresh money before anyone else in the economy even knows it exists.

Step 2: Banks Lend to Preferred Customers

Banks then lend this newly created money to their favorite customers: large corporations, real estate developers, wealthy investors, and institutional borrowers. These privileged borrowers access this new money at incredibly low interest rates because there's suddenly so much liquidity available in the banking system.

Step 3: Asset Prices Inflate First

Here's the key to understanding wealth transfer: These first recipients get to spend the new money while prices are still at previous levels. Real estate developers can purchase properties at current prices using what will become tomorrow's inflated dollars. Private equity firms can buy stocks at pre-inflation prices. Corporations can expand operations or acquire competitors before costs rise.

Step 4: Consumer Prices Begin Rising

As all this new money circulates throughout the economy, demand for goods and services increases. Basic supply and demand economics kicks in—more money chasing the same amount of goods pushes prices higher across the board.

Step 5: Average Americans Feel the Impact Last

By the time working Americans see any benefit from economic stimulus, prices have already inflated. Groceries cost more, gasoline prices rise, rent increases, and healthcare becomes more expensive. Since wages haven't increased proportionally to match inflation, that new money simply means Americans must pay higher prices for the same standard of living.

The Housing Market Reveals the Cantillon Effect in Action

This wealth transfer explains why housing affordability has reached crisis levels for average Americans. Those with first access to cheap credit could purchase real estate before prices soared, while wage earners now face historically unaffordable housing markets.

.png?width=326&height=261&name=unnamed%20(2).png)

However, when we measure home prices in gold rather than dollars, a shocking truth emerges.

While home prices have soared in dollar terms, they've actually crashed when measured against gold. In fact, homes today are nearly as affordable in gold terms as they were during the Great Depression when you strip away currency manipulation.

Why Gold Protects Against the Cantillon Effect

This chart reveals the fundamental problem with fiat currency systems. The dollar has been steadily debased through Federal Reserve money printing, making everything appear more expensive in dollar terms. But gold cannot be printed, manipulated, or created out of thin air by central banks.

Gold serves as a measuring stick that reveals the true purchasing power of paper currencies. When assets are priced in gold instead of dollars, we see their real value stripped of monetary manipulation.

Protecting Your Wealth from Currency Debasement

Every day you keep all your savings in paper-backed assets like stocks, bonds, mutual funds, CDs, and traditional retirement accounts, you're participating in a rigged monetary system.

The rules favor those with first access to newly created money, while your purchasing power gets quietly eroded without notice. It represents the most sophisticated wealth transfer system in modern history.

Gold IRAs: A Strategic Response to Monetary Policy

Smart investors understand that diversifying retirement savings into physical gold provides protection against currency debasement and the Cantillon Effect. Gold IRAs offer a tax-advantaged way to hold precious metals within retirement accounts, providing a hedge against inflation and monetary manipulation.

Unlike paper assets that can be printed into existence, gold maintains its purchasing power over time. Central banks worldwide hold gold reserves precisely because they understand its role as a store of value during periods of currency instability.

The Importance of Precious Metals in Retirement Planning

Professional financial advisors increasingly recommend precious metals allocation as part of diversified retirement portfolios. Gold and silver have historically maintained purchasing power during periods of high inflation and currency devaluation.

Physical gold ownership provides several advantages:

Inflation Protection: Gold typically maintains value during inflationary periods

Currency Hedge: Protection against dollar debasement

Portfolio Diversification: Low correlation with traditional financial assets

Tangible Asset: Physical ownership outside the banking system

Historical Store of Value: Thousands of years of monetary history

Taking Action Against Wealth Transfer

The evidence is clear: through systematic currency debasement, wealth continues transferring from savers to those closest to money creation. Understanding the Cantillon Effect empowers Americans to make informed decisions about protecting their financial future.

Rather than remaining victims of this monetary system, savvy investors are positioning themselves like central banks and wealthy institutions by holding physical precious metals. Gold ownership represents insurance against the ongoing wealth transfer facilitated by Federal Reserve policies.

The choice is clear: continue playing a rigged monetary game, or protect your purchasing power with assets that cannot be printed, manipulated, or devalued by central bank policies.

Your financial future depends on understanding how the monetary system really works, and taking appropriate action to protect your wealth from systematic currency debasement.

The Cantillon Effect isn't going away. Federal Reserve money printing continues, and the wealth transfer accelerates.

The question isn't whether this system will continue, but whether you'll position yourself to benefit from understanding it, or remain a victim of it.

Physical gold and silver represent more than investments. They're financial insurance against a monetary system designed to transfer wealth from savers to those closest to money creation.

In an era of unprecedented money printing and currency manipulation, precious metals offer the same protection that central banks and wealthy institutions have relied upon for generations.