ZeroHedge: Prepare For Empty Store Shelves (Again)

If there’s one thing I’ve learned over the last decade being involved with capital markets, it’s that psychologically, market participants don’t change their tune or their optimistic outlook easily.

More than once, I’ve seen situations where it appeared blindingly obvious to me that both markets and the economy were heading for a crash landing, but the market did not budge in the slightest, nor did its investors.

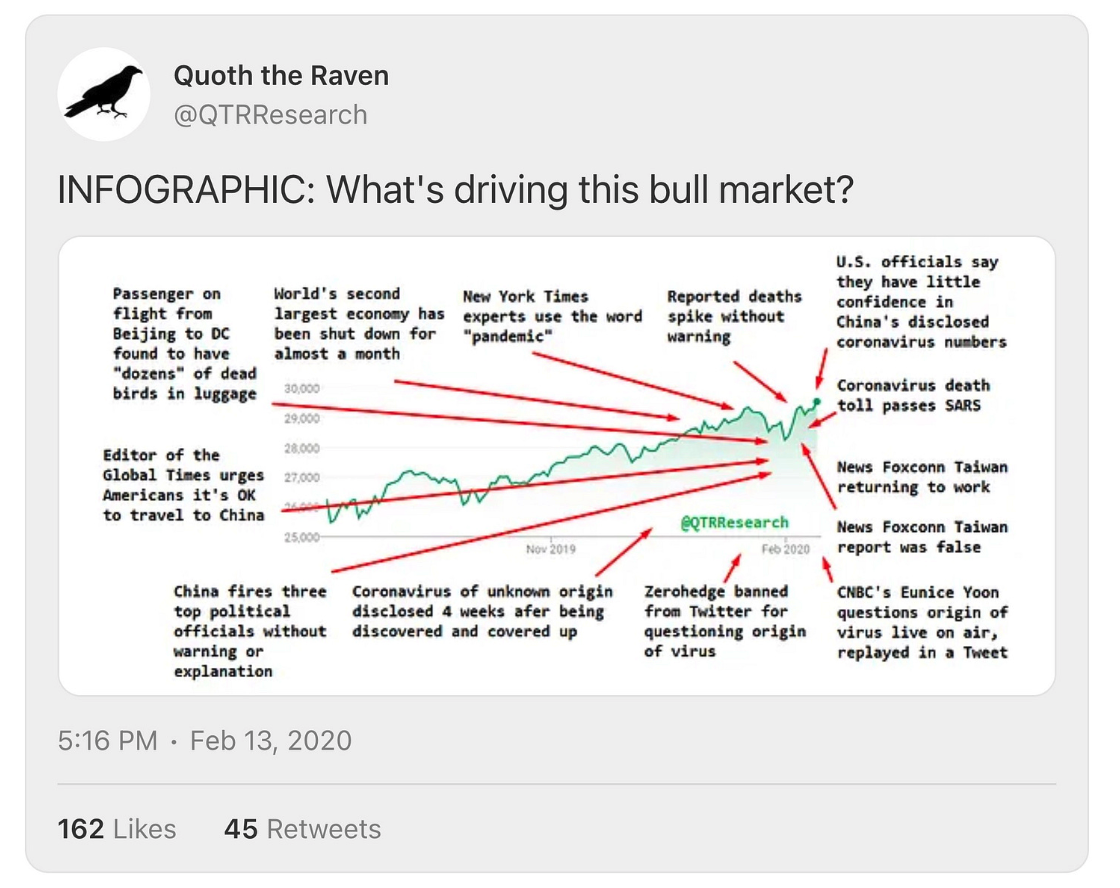

The most recent example of this was Covid. While I sat by and watched the case count grow, and government officials and analysts pretend as though nothing was happening and nothing would change, all the stock market did was go straight up—even as late as February 2020.\

I’ve learned that the market’s default setting is somewhere between blindingly optimistic and extremely irrational hubris and euphoric exuberance. We can thank years of 0% interest rates for this. The new reality is that it takes a tidal wave of bad news to break the psychological backs of market participants. And even then, the market appears to be resilient in its default setting of ignoring valuations and reality in general, so that computers can continue to bid up stocks and retail can continue to goose the markets higher, weaponizing call option gamma as fuel.

We are another living, breathing case study of this as we speak.

Markets tanked over the last couple of weeks because of a reality they couldn’t ignore—namely, astronomical tariffs applied willy-nilly to every country on the face of the Earth—presented to them in a way even the most lobotomized market participants couldn’t ignore: President Trump stood there with a big f*cking chart with the numbers on it and waved it in front of their blank faces while assuring them it was going to happen.

Despite months of TariffTalk™, the market finally had no choice but to swallow and digest this pill because it was presented in such a way that they could no longer ignore.

With Covid, we saw a similar quick sell-off in the markets, along with a spike in volatility, only when the reality of the pandemic was also presented to us in a way we couldn’t ignore: people were beating the sh*t out of each other in the aisles of Costco over toilet paper.

As we’ve seen over the last week or two, markets have rebounded under the guise that tariff and trade deals are being put in place, and that the adults in the room have it all under control somewhere in the background. I don’t know whether or not this is the truth, but it goes to show you that the market is an pornographically optimistic forward-looking indicator because, in the absence of any solidified deals, stocks are trading as though all of the tariff problems created less than a month ago have been solved. They haven’t been.

This leads me to my next point: we may soon be in for another one of those blindingly obvious pills of reality to swallow and digest.

They say history doesn’t repeat, but it rhymes. And I’m no senior vice president at Goldman Sachs, nor am I some PhD opining on macroeconomics, but it is not lost on me that reports of China shipping fewer goods to the United States will eventually hit shelves.

Cargo shipments from China to the U.S. have plummeted since Washington hiked tariffs to 145% in April, with some estimates pointing to a drop as steep as 60%. The sharp decline is being blamed on businesses scrapping orders and postponing deliveries in a bid to sidestep the steep cost increases triggered by the tariff spike.

Just as we saw during Covid, there is a lag between supply chains shutting down and the effects of the shutdown hitting store shelves. As we did back in 2020, stores are going to have to run through all of their current inventory before shelves start to turn up empty. But they eventually do turn up empty.

Out of all the trade deals we’re likely going to strike, China is probably going to come last. They are the crown jewel of trade deals due to the amount we consume from them, but they’re also likely going to be the toughest negotiators with President Trump. We’re talking about a country that welded its people into apartment buildings during Covid—which is to say more about the grit of the common citizen in the country than it is about the authoritarian government. But regardless, both the government and its citizens are far grittier than the United States and will not be the first to fold globally in our trade war against them.

%20(1).png?width=2000&height=1233&name=Untitled%20(24%20%C3%97%2018%20in)%20(1).png)