Why Central Banks Fail To Help Financial Crises and Control Inflation

For decades, Americans have been told that central banks like the Federal Reserve exist to maintain economic stability, prevent financial crises, and control inflation. This narrative has become so deeply embedded in our understanding of modern economics that it seems almost synonymous with the US Dollar.

Yet a growing body of evidence suggests that central banks not only fail at these fundamental tasks but often make economic problems significantly worse.

The Myth of Central Bank Crisis Prevention

The promise was simple: give monetary authorities the power to manage interest rates and money supply, and they would smooth out the boom-and-bust cycles that plagued earlier economic systems. Central banks would act as wise stewards, preventing the kind of financial panics that devastated economies in the 19th and early 20th centuries.

The reality tells a different story entirely.

According to comprehensive data from Laeven and Valencia's banking crisis database, there were 147 banking crises between 1970 and 2011 alone. This occurred during an era of near-universal central bank dominance, when these institutions wielded unprecedented power over global financial systems. Rather than eliminating financial instability, central banking appears to have simply changed its nature while maintaining its frequency.

Consider the major financial disasters of recent decades...

The 2008 Great Financial Crisis didn't happen despite Federal Reserve oversight, it happened because of policies that encouraged excessive risk-taking through artificially low interest rates.

The European sovereign debt crisis emerged from similar monetary distortions.

The inflation surge of 2021-2022 caught central bankers completely off guard, despite their claims of sophisticated economic modeling and data analysis.

How Central Banks Create the Crises They Claim to Prevent

The mechanism by which central banks contribute to financial instability follows a predictable pattern. Through manipulation of interest rates, these institutions create credit booms that fuel asset bubbles and encourage excessive borrowing. When reality inevitably reasserts itself and these bubbles burst, central banks respond with even more aggressive monetary expansion.

This cycle doesn't eliminate financial crises. It amplifies them.

Each intervention creates larger distortions in the economy, leading to more severe corrections when the artificial supports are removed. The "too big to fail" mentality that emerged from central bank policies has created moral hazard on an unprecedented scale, where financial institutions take enormous risks knowing they'll be bailed out if things go wrong.

The costs of these interventions don't disappear. They're transferred to ordinary citizens through inflation, currency debasement, and the erosion of savings. While banks and governments benefit from cheap money and bailouts, working Americans see their purchasing power decline and their retirement savings lose value.

The Inflation Control Illusion

Central banks have proven equally ineffective at their other primary mandate: controlling inflation. Despite sophisticated models, teams of PhD economists, and vast resources, monetary authorities consistently fail to predict or prevent inflationary episodes.

The recent inflation surge provides a perfect case study. As prices began rising in 2021, Federal Reserve officials dismissed the increases as "transitory." They maintained ultra-loose monetary policy well into 2022, even as inflation reached levels not seen in four decades.

This wasn't a failure of forecasting; it was a failure of priorities.

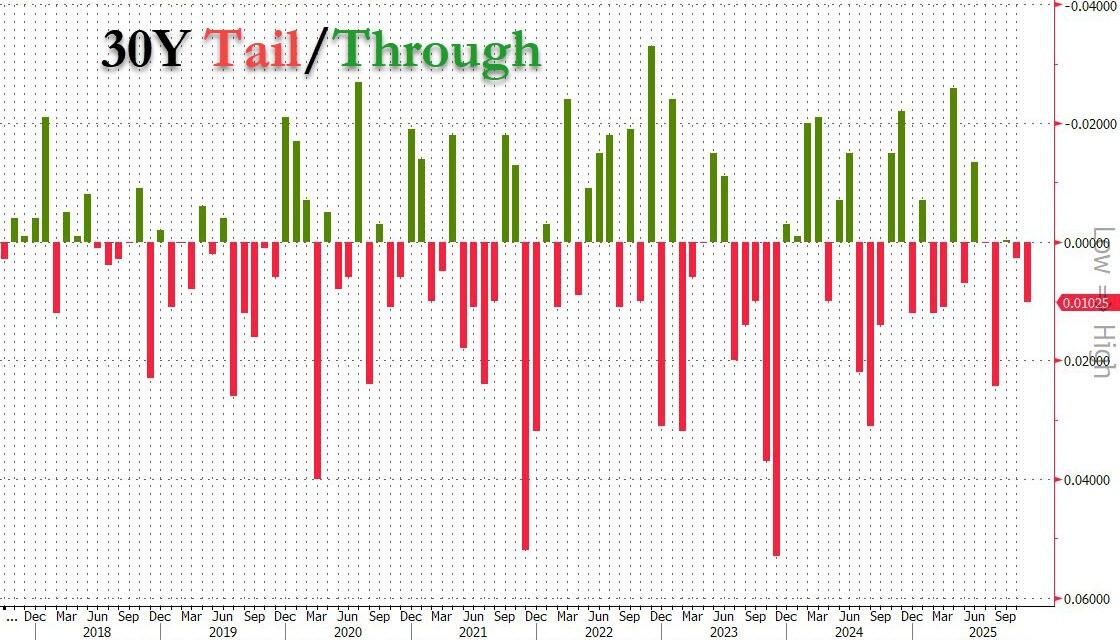

Government Debt Takes Priority Over Price Stability

Modern central banks have increasingly abandoned their inflation-fighting mandate in favor of a new priority: facilitating government debt issuance. When governments need to finance massive deficits, central banks step in with asset purchase programs and artificially low interest rates that make borrowing cheaper and easier.

This shift represents a fundamental change in central banking philosophy. Instead of acting as independent guardians of currency stability, these institutions have become enablers of fiscal irresponsibility. They create the monetary conditions that allow governments to spend beyond their means, then deal with the inflationary consequences by claiming external factors are to blame.

The pattern is clear in policy responses across developed economies. When governments increase spending and debt, central banks accommodate with easier monetary policy. When fiscal authorities attempt to reduce deficits or cut spending, monetary policy mysteriously becomes more restrictive.

This isn't coincidence either. It's coordination designed to support ever-larger government involvement in the economy.

Why Smart Money Is Moving to Hard Assets

The failure of central banks to fulfill their stated missions hasn't gone unnoticed by sophisticated investors and institutions. Countries around the world are quietly accumulating gold reserves at unprecedented rates.

Central banks themselves, the very institutions that print fiat currencies; purchased over 1,000 tons of gold in 2022 (1,082 tons), followed by 1,037 tons in 2023, and maintained their aggressive buying with another 1,045 tons in 2024, marking three consecutive years of purchases exceeding 1,000 tons annually. And it's projected to be over 1000 tons again this year in 2025.

This behavior reveals the true assessment of monetary authorities regarding their own currencies. While they publicly promote confidence in fiat money systems, their actions demonstrate a clear preference for assets that can't be printed, manipulated, or devalued through policy decisions.

Gold has maintained its role as a store of value for thousands of years precisely because it exists outside the control of monetary authorities. Unlike stocks, bonds, or bank deposits, gold's value isn't dependent on the competence or honesty of central bankers. It can't be inflated away through quantitative easing or devalued through negative interest rate policies.

The Systemic Risk of Monetary Central Planning

The fundamental problem with central banking lies in its attempt to centrally plan one of the most complex systems in human civilization: the economy. No group of individuals, regardless of their credentials or intentions, possesses the knowledge necessary to set appropriate interest rates for an entire economy or determine the optimal money supply.

This knowledge problem becomes more severe as economies grow more complex and interconnected. The unintended consequences of monetary interventions ripple through global markets in ways that are impossible to predict or control.

Each attempt to fine-tune economic outcomes creates new distortions that require further interventions, leading to an ever-expanding cycle of market manipulation.

The result is an economy increasingly dependent on central bank support, where natural market mechanisms are suppressed in favor of artificial stimulus. This creates fragility rather than stability, as markets become addicted to monetary accommodation and lose their ability to function independently.

The Path Forward: Recognizing Reality

The evidence is overwhelming that central banks have failed at their core missions of preventing financial crises and controlling inflation.

Rather than providing stability, they have created new forms of instability while transferring wealth from savers to borrowers and from the private sector to government.

Recognizing this reality is the first step toward protecting wealth in an era of monetary instability. Traditional investment strategies based on the assumption of competent central bank management may no longer be adequate. Diversification into assets that exist outside the fiat monetary system becomes not just prudent, but essential.

The 147 banking crises since 1970 aren't anomalies or accidents. They're the predictable result of a monetary system that prioritizes political objectives over economic stability. Until this fundamental problem is addressed, investors must take responsibility for protecting their own wealth rather than trusting institutions that have repeatedly demonstrated their inability to fulfill their promises.

The question isn't whether the next financial crisis will occur...

It's whether you'll be prepared when it does?