Bonds Are Failing, Gold Is Rising: The Run to Gold Has Already Began

Something unusual happened this week that should concern anyone with money in traditional retirement accounts.

The U.S. Treasury tried to sell $25 billion worth of 30-year bonds, and the auction didn't go well. In fact, it was quite disappointing.

For investors watching the bond market closely, this failed Treasury auction signals a troubling shift in confidence that could impact retirement savings across America.

Understanding Treasury Bond Auctions and Why They Matter

Now, we get it. Bond auctions sound about as exciting as watching paint dry. But this particular auction tells us something critical about the state of our financial system, and more importantly, what it means for Americans with retirement savings.

When the government needs money, it sells bonds. Think of it like an IOU. You give the government your money today, and they promise to pay you back with interest over time.

For decades, U.S. Treasury bonds were considered the safest investment on earth. Countries, banks, and investors around the world lined up to buy them.

But that's changing, and changing fast.

What Happened at This Week's Bond Auction

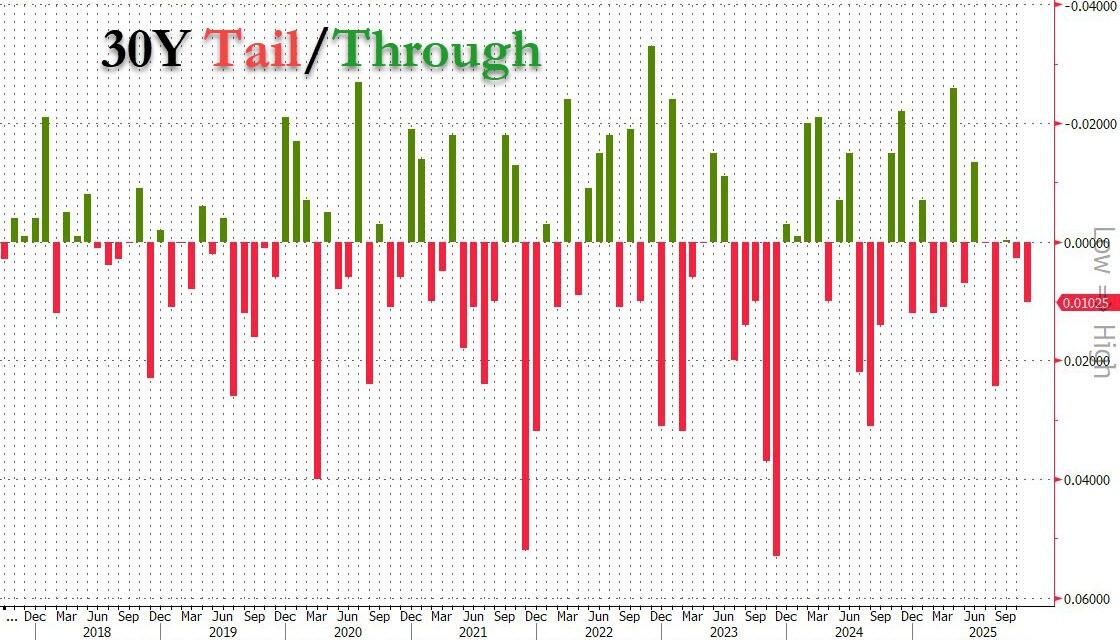

This week's 30-year Treasury bond auction "tailed," which is Wall Street speak for saying that buyers demanded a higher interest rate than expected before they'd hand over their money.

The bid-to-cover ratio, which measures how many people want to buy versus how many bonds are available, dropped to its lowest level since August. And that's because buyers are getting nervous, and they have every reason to be.

Why Failed Bond Auctions Should Concern Retirement Savers

So why does this matter for people with retirement savings in 401(k) plans, IRAs, or TSP accounts?

Well, when bond auctions go poorly, it means investors are losing confidence in the government's ability to manage its debt.

And can you blame them? We're sitting on over $38 trillion in national debt, with over $1 trillion of that added in just the last 71 days.

The government is spending money it doesn't have at a pace we've never before seen in history. And every time they need more money, they have to offer higher interest rates to attract buyers.

How Rising Interest Rates Impact Your Retirement Account

Those higher rates ripple through the entire economy, affecting everything from mortgage rates to the value of existing bonds in your retirement account.

If you have money in bond funds inside your 401(k) or IRA, then you're watching the value slowly erode as rates climb.

If you're in stocks, you're riding a roller coaster that's increasingly disconnected from economic reality.

And if you're sitting in cash, inflation is eating away at your purchasing power every single day.

It's math, the numbers don't lie. The traditional playbook for retirement savings is being rewritten in real time, and most Americans don't even realize it.

The Gold-Backed Bond Proposal That Shocked Wall Street

Now, here's where things get really interesting. Just days before this failed auction, Judy Shelton, a former Federal Reserve nominee under the previous administration, went on CNBC and pitched something that would have been laughed off the air just a few years ago.

She suggested the Treasury should issue gold-backed bonds.

Shelton's argument was straightforward. The current monetary system is unstable, inflationary, and erodes purchasing power. A bond linked to gold would restore trust. She's not wrong.

The fact that this conversation is even happening tells you everything you need to know about where we are in this economic cycle.

As financial analyst David Morgan pointed out, you don't get on CNBC talking about gold-backed bonds unless the "powers that be" have at least considered the idea.

Central Banks Are Buying Gold at Record Levels

That's why central banks around the world are buying gold at record levels. In all of recorded history, central banks have never bought as much gold as they have in the last two years.

These are the smartest financial minds on the planet, the people with access to information that we'll never see, and they're converting paper currency into physical gold faster than it can be printed.

Why? Because as one analyst puts it, bankers know gold is the money of last resort. Said another way, they know what's coming.

Understanding the Run to Gold

We're seeing a run to gold, and it happens in stages. It starts as a light walk, then a normal walk, a brisk walk, a light jog, and eventually an all-out sprint to the finish line.

Right now, we're somewhere between a brisk walk and a light jog. The general public hasn't caught on yet. Your neighbors aren't talking about it at backyard barbecues. But the institutions are moving, and they're moving with purpose.

Gold Price Predictions for 2025-2026

Gold has already climbed significantly, and major banks like Bank of America and JPMorgan are predicting prices could rise to over $5,000 per ounce in 2026.

That's based on the fundamentals of what's happening right now:

- Failing Treasury bond auctions

- Record central bank gold purchases

- Geopolitical instability

- Loss of faith in paper currencies

Every single one of these factors points in the same direction.

Why Timing Matters for Gold Investment

The question isn't whether gold will continue to rise. The question is whether you'll position yourself before the light jog turns into a full sprint.

Because once the general public catches on, once the evening news starts running stories about the dollar's decline and everyone rushes for the exits at once, it'll be too late to get in at reasonable prices.

The premiums will skyrocket, the wait times will extend, and you'll be competing with millions of other Americans who suddenly realized their retirement savings are at risk.

Protecting Your Retirement with Physical Gold

There's a fundamental shift happening in the global financial system. Your 401(k), your IRA, your TSP—they're all denominated in dollars. Which means they're all subject to the same forces that are causing bond auctions to fail and central banks to hoard gold.

Gold IRA Diversification Strategy

Diversifying a portion of your retirement savings into physical gold isn't a radical idea. It's certainty in an increasingly uncertain world.

A Gold IRA allows you to hold physical precious metals within a tax-advantaged retirement account, providing the same benefits as a traditional IRA while adding the protection of tangible assets.

Many Americans are discovering that allocating 10-20% of their retirement portfolio to physical gold can provide:

- Protection against inflation - Gold has historically maintained purchasing power

- Portfolio diversification - Gold often moves inversely to stocks and bonds

- Hedge against economic uncertainty - Physical gold isn't subject to counterparty risk

- Long-term wealth preservation - Gold has been a store of value for thousands of years

How to Get Started with Gold Investment

If you're considering adding physical gold to your retirement strategy, it's important to work with an experienced precious metals dealer who can guide you through the process.

At National Gold Group, our mission is to inform and educate Americans about investing in gold and other precious metals. And present you with no-pressure options that are unique to your goals.

With over 25 years of experience and a 4.9 rating across multiple third-party review sites like Trustpilot and Google, we're here to help you with transparent and no-hassle advice.

Next Steps for Retirement Protection

The evidence is clear. Bond auctions are struggling, central banks are accumulating gold at unprecedented rates, and major financial institutions are predicting significant price increases ahead.

The question is: will you take action before the crowd catches on?