Fed Announces $40 Billion Monthly Money Printing While Cutting Rates For The 3rd Time This Year

Federal Reserve Announces $40 Billion Monthly Money Printing Program Alongside December 2024 Rate Cut

The Federal Reserve just made two critical announcements that should concern every American with retirement savings.

On December 10, 2024, the Fed cut interest rates by 25 basis points to a range of 3.50% to 3.75%, which is the third consecutive rate cut this year.

But the bigger story is what they're doing behind the scenes.

Starting December 12, 2024, the Federal Reserve will begin purchasing $40 billion in Treasury securities each month through a program they're calling "reserve management."

While Fed officials avoid using the term "quantitative easing," make no mistake: this is balance sheet expansion. This is money printing. And it's happening for reasons that reveal serious cracks in the U.S. banking system.

The Fed's December 2025 Interest Rate Decision: A Split Vote Signals Trouble

The Federal Reserve's December 2025 rate cut wasn't unanimous. The vote was 9 to 3, indicating serious disagreement among Federal Open Market Committee (FOMC) members about the appropriate policy direction.

The official narrative focuses on "balancing economic growth with employment concerns." But when you examine what's been happening behind closed doors at the Federal Reserve, a different picture emerges, one of a central bank in crisis mode.

Key Facts About the December 2025 Fed Meeting:

- Rate cut: 25 basis points to 3.50%-3.75%

- Vote split: 9-3

- Third consecutive cut

What the Fed Isn't Telling You: The $125 Billion Emergency Liquidity Injection

While the Fed has been publicly committed to fighting inflation and achieving its 2% target, they've simultaneously been conducting emergency operations to prevent banks from defaulting on their obligations.

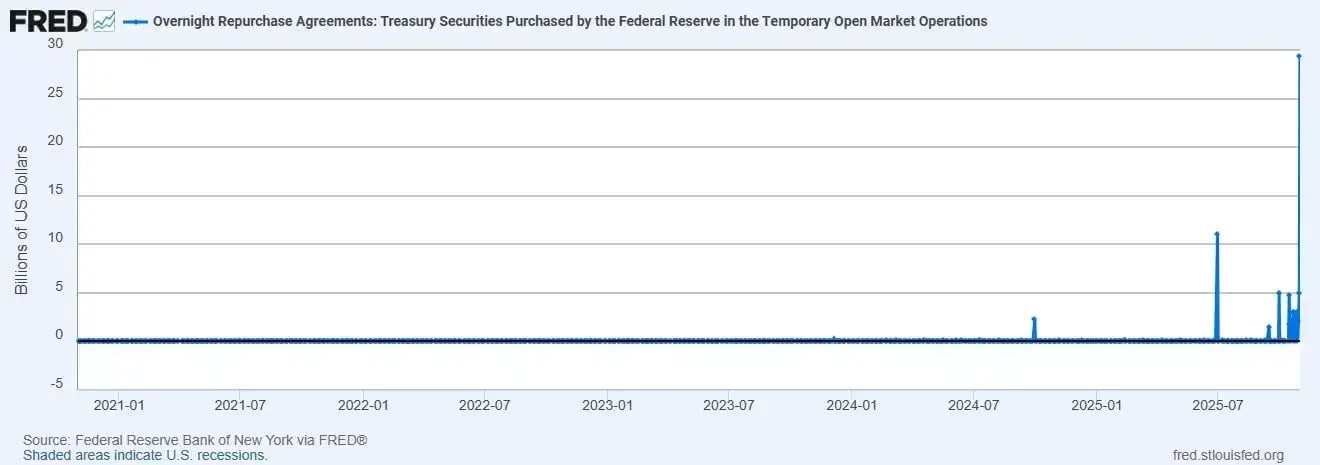

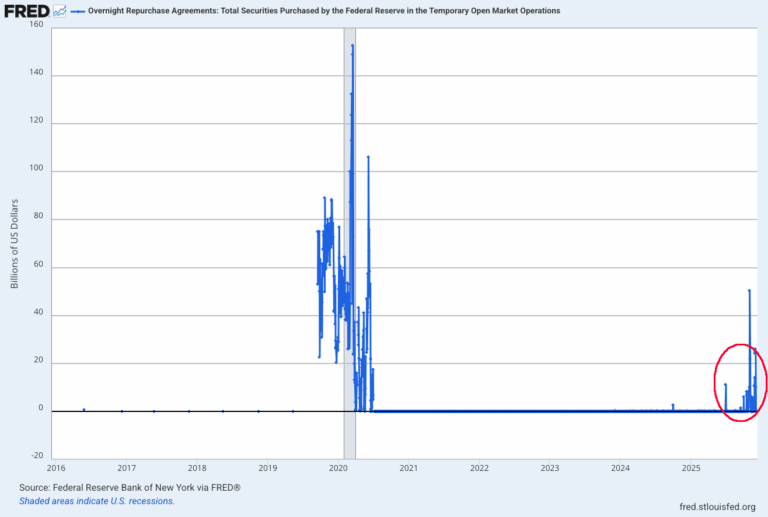

In late October 2025, the Federal Reserve executed a series of overnight repurchase agreements that pumped $125 billion into U.S. banks over just five days.

On October 31 alone, the Fed injected $29.4 billion, which is the largest single-day operation since the COVID-19 pandemic.

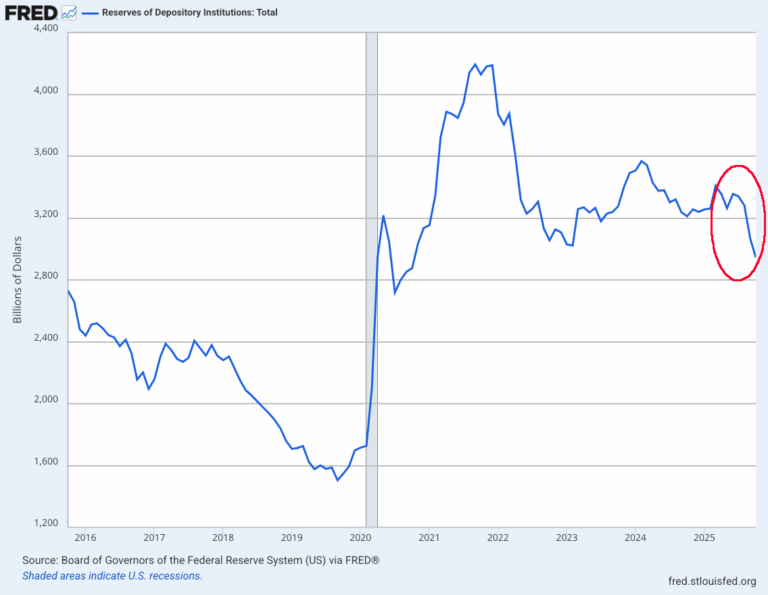

This wasn't announced. It was done quietly, under the radar, because bank reserves had collapsed to $2.8 trillion, the lowest level in four years.

Understanding the Standing Repo Facility: The Fed's Emergency Lever

The tool the Federal Reserve is using is called the Standing Repo Facility (SRF). Think of it as an emergency lever the Fed can pull to offer overnight liquidity when banks can't secure funding through normal channels.

What is the Standing Repo Facility?

The SRF allows eligible financial institutions to exchange high-quality securities (like U.S. Treasuries) for cash on an overnight basis. During the pandemic, this facility was used heavily. Then it sat largely dormant for years. Until now.

In the weeks leading up to the December 2024 Fed meeting, the Standing Repo Facility was activated 16 out of 26 days. That's not normal market behavior. That's a red flag signaling serious stress in the banking system.

Fed "Reserve Management" vs. Quantitative Easing: What's the Difference?

Starting December 12, 2024, the Federal Reserve will begin purchasing $40 billion in Treasury bills monthly. Fed Chair Jerome Powell framed this as "reserve management" rather than quantitative easing (QE), but the distinction is largely semantic.

Here's what's really happening:

| Aspect | Reserve Management (Fed's Term) | Quantitative Easing (Reality) |

|---|---|---|

| Action | Purchasing Treasury securities | Purchasing Treasury securities |

| Effect | Expands Fed balance sheet | Expands Fed balance sheet |

| Purpose | Maintain "ample reserves" | Inject liquidity into system |

| Duration | "As needed" through April 2025 | Typically open-ended |

Powell justified the $40 billion monthly purchases by citing the need for extra liquidity ahead of Tax Day (April 15, 2026). But simple math reveals the scale: $40 billion per month from December through April equals $200 billion in new money creation.

The Inflation Paradox: Fighting Inflation by Creating Inflation?

Here's where the Fed's narrative breaks down completely.

The Federal Reserve claims it's "committed to getting inflation down to 2%."

Yet simultaneously, the Fed is:

✅ Cutting interest rates (making borrowing cheaper)✅ Printing hundreds of billions of dollars (expanding money supply)

✅ Activating emergency liquidity facilities (bailing out stressed banks)

Does that sound like a central bank focused on price stability?

Or does it sound like a central bank in panic mode, desperately trying to prevent systemic collapse while hoping the public doesn't notice the contradiction?

Why Bank Reserves Matter: Understanding the Liquidity Crisis

Bank reserves are the deposits that commercial banks hold at the Federal Reserve. These reserves serve as a cushion for the banking system, allowing banks to meet withdrawal demands and settle interbank transactions.

The Problem:

According to Federal Reserve data, bank reserves have fallen from over $4 trillion in 2022 to $2.8 trillion in late 2025, a decline of nearly 30%.

When reserves fall too low, banks face liquidity constraints that can trigger a cascade of problems:

- Funding stress in overnight lending markets

- Rising repo rates as banks compete for scarce cash

- Potential defaults if banks can't meet obligations

- Systemic risk spreading through interconnected financial institutions

This is why the Fed had no choice but to intervene with massive liquidity injections in October and November 2025.

What This Means for Your Retirement Savings

If you have retirement savings in 401(k)s, IRAs, TSPs, or other cash-backed assets, the Fed's actions have direct implications for your financial future.

The Currency Debasement Effect:

When the Federal Reserve prints money to bail out banks, cuts rates while inflation remains elevated, and expands its balance sheet while claiming to fight inflation, the inevitable result is currency debasement. Every dollar you've saved becomes worth less in real purchasing power terms.

Historical Context:

This isn't theoretical. We've seen this playbook before:

- 2008-2014: Fed balance sheet expanded from $900 billion to $4.5 trillion

- 2020-2022: Fed balance sheet ballooned to $9 trillion during COVID

- Result: Persistent inflation, asset bubbles, and erosion of purchasing power

Why Central Banks Are Buying Gold at Record Levels

Central banks around the world understand what's coming. According to the World Gold Council, central banks purchased over 1,000 tonnes of gold in 2023 and 2024, and will buy over 1,000 tonnes of gold in 2025 as well.

That's the most aggressive buying in decades. In fact, foreign central banks now hold more gold than they do US Treasuries, which hasn't happened in decades.

Why are central banks loading up on gold?

They see the same warning signs:

- Rising national debt growing faster than GDP

- Federal Reserve abandoning its dual mandate

- Banking systems requiring emergency liquidity

- Governments showing no signs of fiscal restraint

- Currency debasement accelerating globally

Gold has been the ultimate store of value for thousands of years precisely because it can't be printed, debased, or created out of thin air by a central bank that's run out of options.

Gold as an Inflation Hedge: Protecting Your Retirement from Fed Policies

When the Fed turns on the money printers, gold doesn't lose value—the dollar does.

Historical Performance During Fed Easing Cycles:

| Period | Fed Action | Gold Performance |

|---|---|---|

| 2008-2011 | QE1, QE2 | +166% |

| 2019-2020 | Rate cuts + QE | +40% |

| 2020-2022 | Massive QE | +25% (despite rate hikes) |

| 2025 | Rate cuts + Balance sheet expansion | +60-64% |

Gold's Historic 2025 Surge:

Gold has experienced its best year since 1979, surging over 60% in 2025 and reaching record highs above $4,300 per ounce by December. This massive rally has been driven by:

- Currency debasement fears from expanded money supply

- Real negative interest rates (inflation exceeding Fed rates)

- Trade war uncertainty and Trump's aggressive tariff policies

- Loss of confidence in fiat currency management and US fiscal policy

With the Fed now officially printing $40 billion monthly and cutting rates despite persistent inflation concerns, gold's role as a store of value has never been more critical for retirement portfolios.

Looking Ahead: Analysts from Goldman Sachs, Bank of America, and Morgan Stanley predict gold could reach $4,500-$5,000 in 2026 as the same drivers—trade tensions, Fed policy shifts, and US debt challenges—continue to fuel safe-haven demand.

How to Protect Your Retirement Savings from Fed Money Printing

You have options. You can diversify your retirement savings into assets that aren't tied to the dollar's fate.

Steps to Consider:

- Evaluate your current allocation: How much of your retirement is in dollar-denominated assets?

- Research precious metals: Gold and silver can be held in tax-advantaged retirement accounts, or purchased with cash and shipped directly to your home

- Work with experienced advisors: Choose firms with proven track records and transparent pricing

- Diversify strategically: Balance between growth assets and inflation hedges

The Fed's Dual Crisis—Inflation and Financial Stability

The Federal Reserve's December 2025 actions reveal a central bank caught between two imperatives: controlling inflation and preventing financial system collapse.

By cutting rates while simultaneously injecting hundreds of billions in liquidity, the Fed is signaling that financial stability has become the priority, even at the cost of its inflation-fighting credibility.

For Americans with retirement savings, this represents a fundamental shift in risk. The dollar's purchasing power is under assault from multiple directions:

- Persistent inflation above the Fed's 2% target

- Massive money printing disguised as "reserve management"

- A banking system requiring emergency support

- National debt growing faster than the economy

The good news: You don't have to be a passive victim of these policies. By diversifying into inflation-resistant assets like gold, you can protect what you've built and preserve your purchasing power for retirement.

The Federal Reserve may have run out of good options. But you haven't.