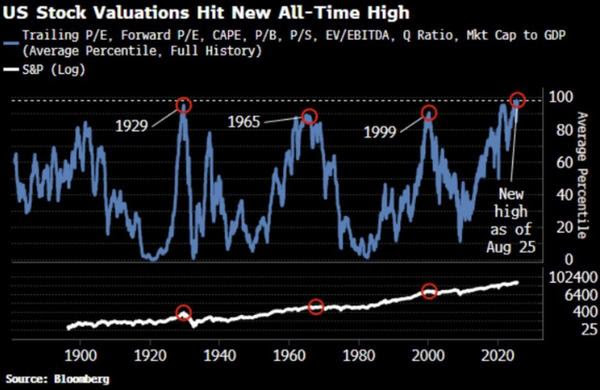

When Stock Valuations Hit Historic Highs, A Market Crash Is Inevitable

The chart showing US stock valuations at all-time highs has ignited fierce debate across financial markets. Some analysts are sounding crash alarms, while others argue that elevated valuations reflect justified optimism about future earnings growth. Meanwhile, seasoned investors point to mega-cap concentration as the real distortion in today's market.

After analyzing decades of historical data and current economic conditions, we think the evidence doesn't just suggest trouble ahead. It screams that a major market crash is not just possible, but inevitable.

The Mathematical Reality That Guarantees a Crash

Here's what the data actually shows: We're facing a situation that has never existed before in financial history, and the laws of mathematics make the outcome predictable. Stock valuations have reached the 100th percentile of their historical range while the US government runs deficits exceeding 6% of GDP.

This combination has never occurred before because it's fundamentally unsustainable.

Every previous period of extreme valuations occurred when the government had fiscal flexibility:

• 1929: Federal debt was just 16% of GDP

• 1999: The government was running budget surpluses

• Today: Federal debt exceeds 120% of GDP and grows faster than the economy

When debt grows faster than the economy that supports it, only three outcomes are mathematically possible: default, inflation, or dramatic spending cuts.

None of these scenarios can support current stock valuations. And we all know the government will never make any dramatic spending cuts. So the crash isn't a matter of if, but when.

Why Forward Earnings Arguments Are Dangerously Misleading

Market bulls desperately cite forward P/E ratios to justify current prices. They note that today's forward P/E of around 23x, while high, hasn't reached the dot-com peak of 27x in 2000.

This comparison is not just wrong, it's dangerously misleading.

In 2000, the US ran budget surpluses and the Fed had massive room to cut rates from 6.5% to near zero. Today, we have crushing deficits and rates already near historic lows with limited cutting power remaining.

Comparing today's market to 2000 is like comparing someone taking on debt with perfect credit to someone already drowning in maxed-out credit cards. The same P/E ratio carries catastrophically different risks.

The Concentration Time Bomb Ready to Explode

Today's market structure has created a financial time bomb. A handful of mega-cap technology stocks now drive the majority of market performance, trading at valuations that assume perfect execution and exponential growth forever.

The equal-weighted S&P 500 has already started telling the real story. It has been significantly underperforming the market-cap weighted version for months, revealing the underlying rot that headline indices desperately try to hide.

When these concentrated positions inevitably disappoint, the impact won't be contained. Unlike previous cycles where weakness in one sector could be offset by strength in others, today's extreme concentration means the entire market will collapse together.

The Crash Timeline Is Already Set

Based on historical precedents and current conditions, the evidence overwhelmingly points to a market decline of 40-60% from peak levels, beginning sometime in the next 12-18 months.

This isn't speculation. It's mathematical inevitability based on how markets have always responded to similar valuation and debt extremes.

The crash will likely unfold in 3 steps:

- Initial 15-20% correction that bulls will dismiss as a "healthy pullback"

- Rapid acceleration as underlying economic weaknesses become undeniable

- Devastating decline as policy response failures become apparent

Why This Crash Could Be Worse Than 2008

Three factors that show this correction could be more severe and longer-lasting than any bear market in living memory:

Policy Impotence: The Fed can't slash rates from 5% to zero like in 2008. The government can't unleash massive stimulus without triggering a debt crisis.

Systemic Fragility: Global financial interconnectedness means contagion will spread faster and more completely than ever before.

Demographic Reality: Baby boomers are net sellers of stocks for retirement just as fewer young investors enter markets, creating structural selling pressure.

The Policy Trap That Seals the Market's Fate

The most damning evidence for an inevitable crash lies in policymakers' complete lack of effective tools. Previous downturns were resolved through aggressive monetary and fiscal intervention. Today's environment makes such responses impossible.

The government already runs deficits that previous generations would have considered catastrophic. The Fed has already exhausted unconventional policies that now produce diminishing returns and dangerous side effects.

When the crash begins, policymakers will be powerless to stop it. This isn't pessimism either, it's just mathematical reality.

Japan after 1990 shows exactly what happens when asset bubbles burst amid high debt and limited policy space: decades of stagnation, not quick recovery.

European debt crises demonstrated that even developed economies face severe constraints when debt levels become unsustainable.

The US may have reserve currency advantages, but these come with global responsibilities that actually limit, rather than expand, policy flexibility during crises.

Why Gold Will Soar When Markets Crash

When this inevitable crash unfolds, traditional safe havens will fail investors just as they need them most. Bonds will suffer as governments struggle with debt crises. Cash will lose value through inflation or debasement. Real estate will collapse under the weight of overleveraging.

Gold stands alone as the only asset class positioned to not just survive, but thrive during the coming crisis.

Here's why gold's bull run is just beginning:

Central Bank Desperation: As fiat currencies face existential pressure, central banks worldwide are already accelerating gold purchases. China alone added 120 tons in the first half of 2025, signaling a strategic shift away from dollar dependence.

Currency Debasement Protection: When governments face impossible debt mathematics, they always choose inflation over default. Gold provides the only reliable protection against this inevitable currency debasement.

Crisis Demand Surge: During the 2008 crisis, gold rose 25% while stocks crashed 50%. The coming crisis will be more severe, making gold's outperformance even more dramatic.

Supply Constraints: Gold mining production has been declining while demand surges. This supply-demand imbalance will drive prices exponentially higher during crisis conditions.

Institutional Recognition: Major financial institutions now project gold reaching $3,100-$4,000 per ounce by 2025-2026, and these projections assume normal market conditions. During a major crash, these targets will prove conservative.

The Smart Money Is Already Moving

The evidence shows sophisticated investors are already positioning for this reality. Central banks have been net buyers of gold for 15 consecutive years, with purchases accelerating dramatically since 2022. High net worth investors have nearly doubled their gold allocations in the past year.

They're not buying gold for returns. They're buying it for survival.

When stock markets crash 40-60% and traditional safe havens fail, gold will be the only asset providing both capital preservation and appreciation potential.

The Bottom Line

The mathematical realities are inescapable. Current conditions cannot and will not persist. History provides crystal clear guidance about what happens when they don't.

The crash is coming. The only questions are timing and magnitude, both of which the data suggests will be sooner and larger than most investors expect.

Those who recognize these realities and position themselves in gold before the crash will not only preserve their wealth but will profit enormously from the inevitable flight to safety.

Those who continue believing in the fantasy of perpetual market growth built on unsustainable debt will learn the hard way that mathematics always wins in the end.

The choice is simple: prepare now or pay later.

The data has already made the decision for you.